Legislative Alerts

This update informs members about breaking news or urges immediate action on issues of importance to local school boards.

The process for the General Assembly to approve a budget for the next fiscal year came into a slightly better focus as the Joint Budget Committee (JBC) of the Colorado Legislature received the December revenue forecast. The JBC receives quarterly forecasts from the nonpartisan Legislative Council Staff (LCS) and Governor Jared Polis’s Office of State Budget and Planning (OSPB). The December revenue forecast tends to be the second most important forecast of the year as it provides a glimpse of the state economy to legislators immediately before they convene for the 120-day legislative session in January 2024.

The two forecasts cover similar data with the OSPB forecast reflecting the priorities of the Governor. The LCS forecast is here and the OSPB forecast is available here. CASB members can also view the presentations made to the JBC - LCS here and OSPB here.

Some background information may be helpful to understand the December forecast. Colorado’s economy has ranked among the best in the nation for an extended period of time. Even following the COVID pandemic economic shutdown, Colorado recovered much more quickly than many states. In addition, Colorado is the only state in the nation where the legislature does not have the ability to make most of the tax policy. The Colorado Taxpayer Bill of Rights (TABOR) enshrines the tax code in the Colorado Constitution. TABOR requires the state to refund tax revenue to citizens which exceeds the limits set by TABOR. Additionally, TABOR calls for a vote of the people before taxes are raised.

Heading into the 2024 Legislative session, the economy in Colorado continues to be strong according to state economists, but the pace of growth will slow in 2024. It is also likely that lawmakers will have fewer dollars to spend on their legislative agenda. The risk of recession continues to shadow the state’s economy with economists from OSPB suggesting as much as a 30% chance for a recession in 2024. Of particular concern is the uncertainty of corporate income tax collections, slightly higher unemployment, and ongoing housing affordability across the state.

CASB members, of course, are most focused on aspects related to public school funding. The Legislative Council Staff highlighted several factors that are concerning for K-12 education:

|

(Source Colorado Department of Education and Legislative Council Staff December 2023 forecast)

|

SB23-287, which funds school finance for the 2023-24 fiscal year, included language to finally pay off the Budget Stabilization Factor (BSF) in 2024-25. Although a past legislature can’t legally encumber a future legislature, the intent by the General Assembly to fulfill the legislative mandate to pay off the Budget Stabilization Factor is clearly a priority for the General Assembly and the Governor. K-12 Education accounts for one of the biggest chunks of the state budget. Lawmakers will also have to tackle how to implement a new “At-Risk” factor to assist students who need additional services. The price tag on that isn’t known at this time, but will likely be a key debate for the next school finance act.

The Colorado General Assembly will begin its 120 days of legally allowed legislative work on Wednesday, January 10, 2024. CASB members are encouraged to participate in the Legislative Resolutions Committee (LRC). There are several openings on the LRC for board members from locally elected Boards of Education. The LRC meets on the 2nd and 4th Fridays of the month at 1:30 p.m., January through May. The meetings are always online. If you are interested please contact CASB Director of Public Policy and Advocacy Matt Cook at [email protected].

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

Good afternoon,

On Wednesday, November 29, 2023, Colorado Governor Jared Polis released a statement asking local government officials to consider reducing property taxes via mill levy assessments, where the local government has discretion to do so. In a separate letter sent to Colorado’s 178 school districts, the governor thanked schools for supporting Colorado students and requested the locally elected Boards of Education do what they can to reduce property taxes as well.

As you know, school taxes are levied in a variety of ways: total program mills, mill levy overrides, bond mills, and other special mills. Of those four, mill levy overrides and special mills, if your district has one, are likely the only items the Governor references which are available for school board discretion. You should, of course, consult your district legal counsel for specifics.

The purpose of this letter is to offer CASB’s support as school boards navigate this complex topic and provide guidance gathered from state education organizations including the Colorado School Finance Project.

Initial Guidance

It is important to note that nothing in the Governor’s letter requires any Colorado School District to take action. Colorado statutes are quite clear that the authority to certify mill levy overrides rests solely with the 178 locally elected Boards of Education within the state. Specific guidance for consulting your legal counsel can be found in the Colorado School Finance Project document referenced below.

Colorado law normally requires a local Board of Education to certify the mill levy in December of each year. However, in the recently completed Special Session of the Colorado General Assembly lawmakers approved SB23B-001 Property Tax Relief. The bill extends the date to certify until January 10, 2024.

CASB Resources

Given the brief time frame and the many implications of the Governor’s request, CASB staff will be providing an opportunity for CASB members who are attending the 83rd Annual CASB Convention to better understand this complex issue. Tracie Rainey, Executive Director of the Colorado School Finance Project, and Amy Canfield Vice-President of Stifel will present information and take your questions during a Thursday afternoon session entitled, “Assessing School Board Mill Levy Discretion.”

Citizens may pose a tax related question to school boards in the next thirty days. CASB advises that boards and superintendents remind stakeholders that mill levies have been made with specific purposes in mind–for projects, construction of facilities, programs, and often for additional staffing. Reducing any mill levies is a significant policy decision that will impact stakeholders as well as the district’s finances. The school board has a brief window of opportunity to engage our community with specific changes, but the board will endeavor to engage the community on decisions that will alter the intention of the voters to provide the school district with additional revenues for specific purposes that provide the very best for district students.

CASB is providing the attached FAQ to address your more immediate questions, and can provide ongoing support as you address this complex and complicated situation.

Please contact your CASB staff at [email protected] or 303-832-1000 for additional information.

|

Governor’s Communication to School Board Directors re: Mill Levies - 11/29/2023

Frequently Asked Questions & Answers for Districts and School Board Members

Colorado School Finance Project

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

Called Back to Work

Colorado Governor Jared Polis issued a call for the General Assembly to convene in a Special Session to address immediate property tax relief for the state. This morning, the Governor signed the executive order calling legislators back to work. Details will be forthcoming in the next few days.

It is expected that the General Assembly will focus on these items in regard to property taxes:

-

Immediate property tax relief for all Colorado property owners for the current tax year

-

Implement a “blue ribbon” panel to study a long term solution to the question of how Colorado property taxes will be implemented going forward

-

Develop a plan to “backfill” local governments - including school districts - from the potential loss of decreased property taxes

The Governor repeatedly stated that the General Assembly could not wait to take action because local governments, which include school districts, must certify mill levy tax rates by December 15. This deadline allows county assessors the time necessary to prepare tax assessment documents for property owners. At this time it does not appear there is one clear plan for legislators to consider on the property tax issue.

Additionally the Governor included an item to allow Colorado school districts to leverage a federal program to pay for meals during the summer of 2024 for approximately 300,000 Colorado students. Governor Polis stated:

"Passing legislation as soon as possible will enable us to stand up this critical program in time for this summer and access approximately $35 million in federal benefits."

The General Assembly can pass a bill in three working days, but it is anyone's guess as to how long legislators will take to work on these issues.

The General Assembly will convene on Friday, November 17, 2023 at 9:00 a.m. Your CASB staff will be providing updates as legislators continue their work.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

The process for the General Assembly to approve a budget for the next fiscal year kicked off today with the submission of Governor Jared Polis’s budget request to the Joint Budget Committee (JBC) of the Colorado Legislature. By law, the governor must send this request to the Legislature on November 1 of each year.

The initial budget request from the governor rarely looks like the finished product the General Assembly will approve in the late spring of next year. However, it is an important clue as to what priorities the governor will be looking to fund. The complete letter and related information from the governor is available here.

CASB members should be most interested in the governor’s commitment to completely pay off the long standing debt owed to Colorado students in the form of the Budget Stabilization Factor (BSF). The General Assembly in the 2023-24 school finance act included language to fully buy down the BSF in the upcoming fiscal year. The Governor added his support stating in his letter:

"With this budget, we are finally fulfilling our promise to the voters to fully fund our schools. I am excited to work with the JBC and the General Assembly to increase teacher pay, reduce class size, and make sure every Colorado student has access to an excellent school."

The budget proposal includes more than $564 million to increase public school funding. This amount includes $141.3 million to retire the BSF. By paying off the BSF, the state would make good on the intentions of Colorado voters when they approved Amendment 23 to the state’s Constitution, which was ratified in 2000. The funds would come from the State Education Fund and the General Fund.

Additionally, the governor proposed funding for the following education priorities:

Other highlights of the governor’s budget request include:

Members of the JBC will begin their work on the budget starting mid-November. The committee schedule is available here. Keep in mind the schedule can potentially, and often does, change. Committee staff will present on issues related to the Colorado Department of Education several times in the weeks leading up to the start of the legislative session in January of 2024.

The JBC will receive the December quarterly revenue forecast on Wednesday, December 20. The December revenue forecast provides committee members a final update on the relative health of the state economy before the 100 elected members of the General Assembly begin their work in the new year.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

February 27, 2023

SB23-071 “Education Accountability Act”

CASB members from the Adams 14 School District and other proponents worked to bring this bill forward. The bill is in response to the ruling from the State Board of Education regarding Adams 14 school accountability. The Adams 14 school district additionally brought legal action against the State Board of Education. The court case was pending in the Court of Appeals, but a request was filed for the Colorado Supreme Court to take jurisdiction over the appeal.

On Monday February 27, 2023, the Colorado Supreme Court granted the request to hear the case. Supporters of the bill and the bill sponsor Senator Jessie Danielson have decided to “Postpone Indefinitely” (PI) SB23-071, to allow the Supreme Court to rule on the merits of the appeal. Moving the bill to “PI” means that this particular bill cannot be brought back during the current Legislative session. The CASB Legislative Resolutions Committee had officially recorded a position of Amend on SB23-071.

If you have questions or need more information, please contact Matt Cook ([email protected]), CASB Director of Public Policy and Advocacy.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

The Colorado General Assembly is down to the final 3 working days of the 2022 session. In an effort to keep CASB members up to date on the latest legislative action, the CASB staff is sending this update today. Keep your eyes on your inbox on Friday, May 13 for a complete wrap-up in the CASB School Board Advocate.

Once the Colorado legislature adjourns for the year, please make plans to attend one of the CASB Legislative Wrap-Up meetings. CASB Executive Director, Cheri Wrench, and CASB Director of Public Policy and Advocacy, Matt Cook, are heading out on the road to break down all of the legislative action. The meetings are available to all CASB members at no cost, but you must register in advance. All of the details are available on the CASB website.

Bill Update

SB22-238 2023 and 2024 Property Taxes - The bill would work to offset some of the effects of the significant increases in assessed property valuations some parts of the state have seen. Funds to backfill tax revenue that would be lost due to decreases in the Assessment Rates would come from a combination of state General Fund and refunds to Colorado taxpayers under the state’s Taxpayer Bill of Rights (TABOR).

The breakdown looks like this:

- For 2023 residential tax assessment rates would fall to 6.67% from the current 7.15%

- For 2023 business tax assessment rates would fall to 27.9% from the current 29%

- For 2024 residential tax assessment rates increase slightly to 6.9% due to SB21-293, which the Legislature passed last session

- For 2024 business tax assessment rates would be set at 26.4%

- The Fiscal note highlights that public schools would be backfilled for lost property tax revenue

- $183 million for 2023-24

- $73 million for 2024-25

The bill is an attempt by the Governor’s office and the General Assembly to remove a slate of property tax initiatives that are currently being considered by a number of state policy groups. The bill moved quickly through the Senate. It is expected to move equally fast in the House as it had already been heard in the House Appropriations Committee as of the time this alert was published. However, the deal is anything but a “slam dunk.” Opponents of the bill have continued to express concerns with the use of TABOR refunds, and say they are not ready to sign off on a deal until those concerns are addressed.

HB22-1390 Public School Finance - The Colorado Senate passed the bill this week which is good news for CASB members. The House and Senate will now need to agree on amendments before taking a vote to repass the bill and send it to the Governor. The current fiscal note has information about the reengrossed version of the bill. Please see previous editions of the CASB School Board Advocate for bill details and additional information.

SB22-127 Special Education Funding - Both chambers have now passed the bill to provide additional resources for Colorado’s most vulnerable learners. The bill is headed to the desk of Colorado Governor Jared Polis. The bill will provide $80 million in new funding specifically for special education students. The bill’s fiscal note has additional details.

HB22-1358 Clean Water in Schools and Child Care Centers - The introduced bill had numerous items concerning CASB members. CASB, along with other education advocacy groups, worked with the bill sponsors to amend the bill to a more workable format. CASB members can compare the introduced version of the bill and the most recent version to see the significant changes. The bill is moving through the Senate after it was approved in the House.

SB22-202 State Match for Mill Levy Override Revenue - Senate Appropriations provided $20 million to fund this bill before the full Senate approved the bill and sent it to the House. Under the bill, 30 school districts that have already passed a Mill Levy Override (MLO) would be eligible to apply to the state to match grant programs to leverage some additional funds. The bill’s fiscal note highlights the 30 districts that are currently eligible.

SB22-214 General Fund Transfer to PERA Payment Cash Fund & HB22-1029 Compensatory Direct Distribution to PERA - The General Assembly under SB18-200 set a goal to ensure the Colorado Public Employees’ Retirement Association (PERA) will be fully funded in 40 years. The 2022 General Assembly is providing funds to help ensure that PERA reaches the full funding goal. SB22-214 makes an appropriation of $198 million. HB22-1029 would provide funds to help make up the opportunity lost for investment gains caused by the General Assembly not making PERA contributions in the 2020 and 2021 fiscal years due to the COVID health pandemic. HB22-1029 may not make it to the finish line as the bill has yet to be scheduled for House Appropriations.

HB22-1260 Medically Necessary Services - This heavily amended bill has passed both chambers and is awaiting action by the Governor. As amended, the bill would require Administrative Units to adopt a policy to explain how a student with a prescription from a medical provider can receive treatment while in school.

SB22-207 Prevention of Title IX Misconduct in Public Schools - The CASB Policy and Legal teams provided significant input to the bill sponsors on this important topic. Given that the United States Secretary of the Department of Education, Miguel Cardona, has said the Federal Government will introduce major revisions to Title IX in May of this year, CASB and other education groups advocated for a study to be conducted to determine how best Colorado and Federal law can work together to ensure the goals of Title IX are carried out. Amendments L011 and L013 outline the process. The bill has passed both chambers and is on the way to the Governor’s desk.

HB22-1311 Reduce Justice Involvement for Young Children - This bill will create a task force to study how best to provide services for young people who need them and minimize their interaction with law enforcement. As introduced, the bill raised some important questions around how schools deal with very young children who may be criminal offenders. CASB worked with multiple education advocacy groups in an attempt to bring a workable solution forward. After many hours of discussion, the bill was amended (L027) to call for a task force to study these complex issues and bring their findings back to the General Assembly. The bill has passed the House and Senate and now awaits the Governor’s signature.

HB22-1376 Supportive Learning Environments for K12 Students - The bill, as introduced, would require the Colorado Department of Education (CDE) to standardize the reporting method districts use to collect and report data relating to suspensions, expulsions, arrests, referrals, chronic absenteeism, etc. CDE would also be required to create a publicly-accessible district profile relating to the data collected for suspensions, expulsions, arrests, referrals, chronic absenteeism, etc. The bill would also add information for principals to include in their annual reports to the local board and would require districts to update their safe schools policy to reflect the bill's changes. Additionally, the bill would change the definition of "physical restraint" to mean the use of force used for more than one minute, and would require seclusion rooms, if used, to have a window or video camera for continuous student monitoring. The bill would also limit School Resource Officer (SRO) use of handcuffs to certain situations and would require the Peace Officer Standards and Training (POST) Board to develop a model policy on SROs that districts may, but would not be required to, adopt. The bill had a dozen amendments proposed during debate on the bill. The majority of these amendments were suggested by CASB and other advocacy groups including the Consortium of Special Education Directors of Colorado. The introduced bill and the reengrossed version show the significance of the amendments adopted.

End of the Session

The General Assembly must adjourn on Wednesday, May 11, 2022. Once the final vote has been taken, CASB staff will have a full update regarding all of the bills that were approved in the May 13th School Board Advocate and the Legislative Summary later this spring. Past editions of the School Board Advocate and the audio recordings of the same are available on the CASB website. The adopted bills will begin to be incorporated into the quarterly CASB Special Policy Updates starting with those bills that require an adjustment to current school district policy.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

The number of legislative days in the 2022 Colorado General Assembly session is down to single digits with May 11 as the final day of the session. There is plenty of work for legislators to do with more than 200 bills still pending action in one or both chambers. With all that in mind, members of the General Assembly and Governor Jared Polis added to the workload with a bill to try and head off a November ballot question that could significantly impact the taxes Colorado residents pay on their business and personal properties. SB22-238 will work to offset some of the effects of the significant increases in assessed property valuations some parts of the state have seen. The money to do this would come from a combination of state General Fund and refunds to Colorado taxpayers under the state’s Taxpayer Bill of Rights (TABOR).

The breakdown looks like this:

- For 2023 residential tax assessment rates would fall to 6.67% from the current 7.15%

- For 2023 business tax assessment rates would fall to 27.9% from the current 29%

- For 2024 residential tax assessment rates increase slightly to 6.9% due to SB21-293, which the Legislature passed last session

- For 2024 business tax assessment rates would be set at 26.4%

- The Fiscal note highlights that public schools would be backfilled for lost property tax revenue

- $183 million for 2023-24

- $73 million for 2024-25

The bill would use a combination of funds to backfill revenue lost to local government entities that rely on property taxes to fund portions of their operations, like counties and school districts. Part of the backfill funding would come from the General Assembly’s General Fund, with an additional amount coming from tax revenue the state already has collected but is due to be refunded to state taxpayers under the requirements of TABOR. The bill is an attempt by the Governor’s office and the General Assembly to remove a slate of property tax initiatives that are currently being considered by a number of state policy groups.

In other news, the 2022-23 Colorado School Finance Act - HB22-1390 is moving through the Senate. However, it appears to have come to a roadblock in the Senate Appropriations Committee. Please take two minutes and contact Colorado Senators and ask them to move forward with the passage of the School Finance Act. CASB member boards need to hold public budget hearings and adopt a budget by July 1. Follow this link to take action now.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

The Colorado General Assembly is working through the final 12 days of the 2022 Legislative session. As the days wind down the pace of bills quickly picks up. In an effort to keep CASB members apprised of the latest from the Gold Dome, CASB staff will be sending Legislative Updates each Friday until the end of the session.

Once the Colorado legislature adjourns for the year please make plans to attend one of the CASB Legislative Wrap-Up meetings. CASB Executive Director, Cheri Wrench, and CASB Director of Public Policy and Advocacy, Matt Cook, are heading out on the road to break down all of the legislative action. The meetings are available to all CASB members at no cost, but you must register in advance. All of the details are available on the CASB website.

|

Bill Updates

HB22-1390 Public School Finance - The Colorado House has approved the bill which provides public school funding for the upcoming school year. The Senate Education Committee heard the bill on Thursday this week. It is expected the full Senate will begin debating the bill early next week. Please see previous editions of the CASB School Board Advocate for bill details and additional information.

SB22-127 Special Education Funding - This bill had been stuck on the House calendar awaiting 3rd reading. The House voted to approve on Friday morning. The bill will be heading to the desk of Colorado Governor Jared Polis. As approved it provides $80 million in new funding specifically for special education students. The bill’s fiscal note has additional details.

SB22-214 General Fund Transfer to PERA Payment Cash Fund - The General Assembly under SB18-200 sets a goal to ensure the Colorado Public Employees’ Retirement Association (PERA) is fully funded in 40 years. A significant portion of that goal is accomplished by payments from the state's General Fund to PERA. The bill was approved by the Senate. The House Appropriations Committee is expected to hear the bill very soon before it heads to the full House for consideration.

SB22-202 State Match for Mill Levy Override Revenue - In a move that many at the Capitol did not see coming, Senate Appropriations provided $20 million to fund this bill. The bill would make available a state match for a local school district with low assessed property valuations to apply for a match to a local Mill Levy Override (MLO). Once the bill is introduced in the House, a new fiscal note will be issued providing clarity as to how funds will be allocated.

HB22-1260 Medically Necessary Services - This heavily amended bill was approved by the House. As amended, the bill would require Administrative Units to adopt a policy to explain how a student with a prescription from a medical provider can receive treatment while in school. The full House and the Senate Education Committee have approved the bill. The next step is a date on the Senate Appropriations calendar.

SB22-207 Prevention of Title IX Misconduct in Public Schools - The CASB Policy and Legal teams provided significant input to the bill sponsors on this important topic. Given that the United States Secretary of the Department of Education, Miguel Cardona, has said the Federal Government will introduce major revisions to Title IX in May of this year, CASB and other education groups advocated for a study to be conducted to determine how best Colorado and Federal law can work together to ensure the goals of Title IX are carried out. Amendment L001 outlines the process.

HB22-1311 Reduce Justice Involvement for Young Children - This bill will create a task force to study how best to provide services for young people who need them and minimize their interaction with law enforcement. As introduced, the bill raised some important questions around how schools deal with very young children who may be criminal offenders. CASB worked with multiple education advocacy groups in an attempt to bring a workable solution forward. After many hours of discussion, the bill was amended to call for a task force to study these complex issues and bring their findings back to the General Assembly.

The CASB website has several tools to help you track all of the bills moving through the legislative process as the session winds down. Head over to the CASB website for all the information.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

The Long Bill Drops

The Colorado House introduced HB22-1329 Long Bill which provides the funds for the state Government to operate for the 2022-23 fiscal year. The bill accounts for $37.73 billion in state funds. Educating Colorado students accounts for $6.7 billion of the overall number. The Long Bill begins in the Colorado House, then once approved will head to the Colorado Senate before heading back to the General Assembly Joint Budget Committee (JBC) who will act as the conference committee to match up the House and Senate versions. Once both chambers concur on the bill, it will be sent to Colorado Governor Jared Polis for his signature.

As CASB members know, the Long Bill is the first step towards the total funding for Colorado schools. Colorado law requires a separate School Finance Act (SFA). The SFA is anticipated to be introduced soon as Colorado lawmakers must legally adjourn on May 12. While the bill is titled the Long Bill, it is surprisingly short at only nine pages. However, all of the meat of the bill is located in supporting bill documents.

The Long Bill includes several important “placeholders” for money that will be allocated to Colorado schools via the School Finance Act. These placeholders include:

- $182 million to buy down the Budget Stabilization Factor (BSF)

- The JBC previously appropriated $68 to buy down the BSF as a supplemental to the 2021-22 fiscal year - HB22-1186 - for a total BSF buy down of $250 year over year

- $80 million to fund students with Special Education needs

- Funded via SB22-127 Special Education Funding

- Payments to PERA

- Payment outlined in SB18-200 Modifications to PERA to Eliminate Unfunded Liability

- Funding will be addressed via HB22-1029 Compensatory Direct Payments to PERA

- PERA provides retirement income for the overwhelming majority of Colorado Educators

In total, CASB Boards of Education members potentially will have $330 million to provide for the education of Colorado students. Please join CASB in contacting your Colorado legislators and ask them to support all of our students and make funding for Colorado public education a priority. Follow this link to take action now.

The Department of Early Childhood and Universal Preschool

HB22-1295 will create a new department to administer the voter-approved statewide Early Childhood Education program. The bill has been approved, as amended, by the Colorado House. The significant amendments already included in the House version of the bill are:

- L002 - Requires the Executive Director to submit written rationale if they chose not to accept the recommendation of the Advisory Council

- CASB advocated for an appointed Board of Directors for the new department

- House bill sponsors, the Speaker’s office, and the Governor’s office were not supportive of that model. The amendment allows for transparency when/if the Executive Director of the new department were to decide against the suggestions of the Advisory Council

- Page 31 of the bill, lines 14 to 27, and page 32, lines 1 to 5, provide for an external entity to evaluate the governance and process of the department, as well as, report their findings to the General Assembly

- L009 - Licensure flexibility

- Colorado has a shortage of educators. The needs of early childhood educators are particularly acute. The amended language provides additional flexibility in an attempt to staff classrooms

- L013 - Department of Education Resource Bank

- Requires the Colorado Department of Education to provide a resource bank of appropriate material for Early Childhood Educators

- The resource bank is also required to be available to the public

- L016 - Funding for the 2022-23 & 2023-24 school years

- Provides funding at the current funding levels for the 2022-23 and 2023-24 school years

CASB anticipates additional amendments to further clarify the rules regarding Local Coordinating Organizations (LCO) and amended language to address how local school districts that have Mill Levy Overrides (MLO) specifically for early childhood education are accounted for.

The complete bill text for the version passed by the Colorado House is here. House amendments are SHADED.

HB22-1295 is scheduled to be heard by the Colorado Senate Education Committee on Thursday, March 31 at 1:30 p.m.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

March Revenue Forecast

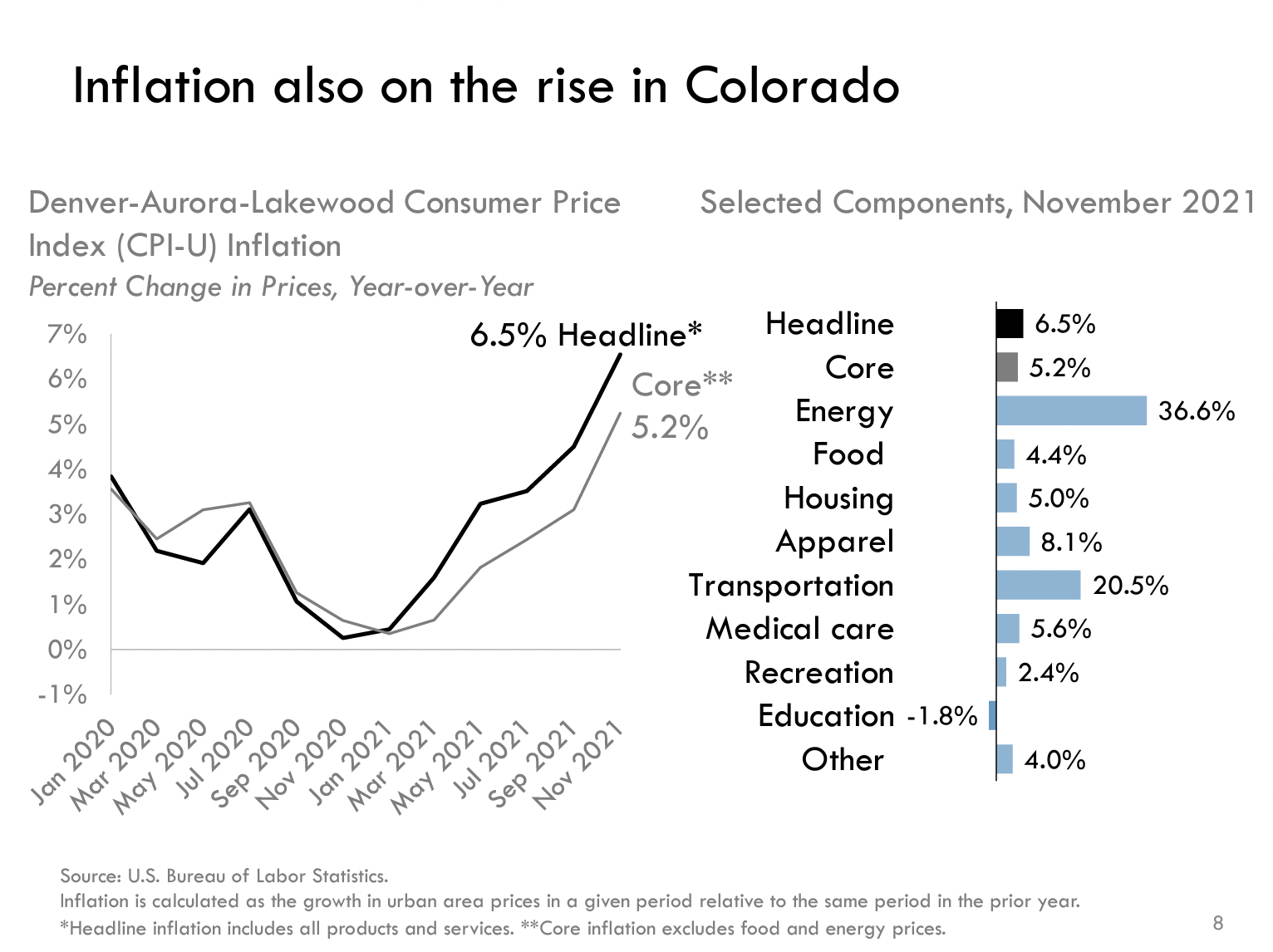

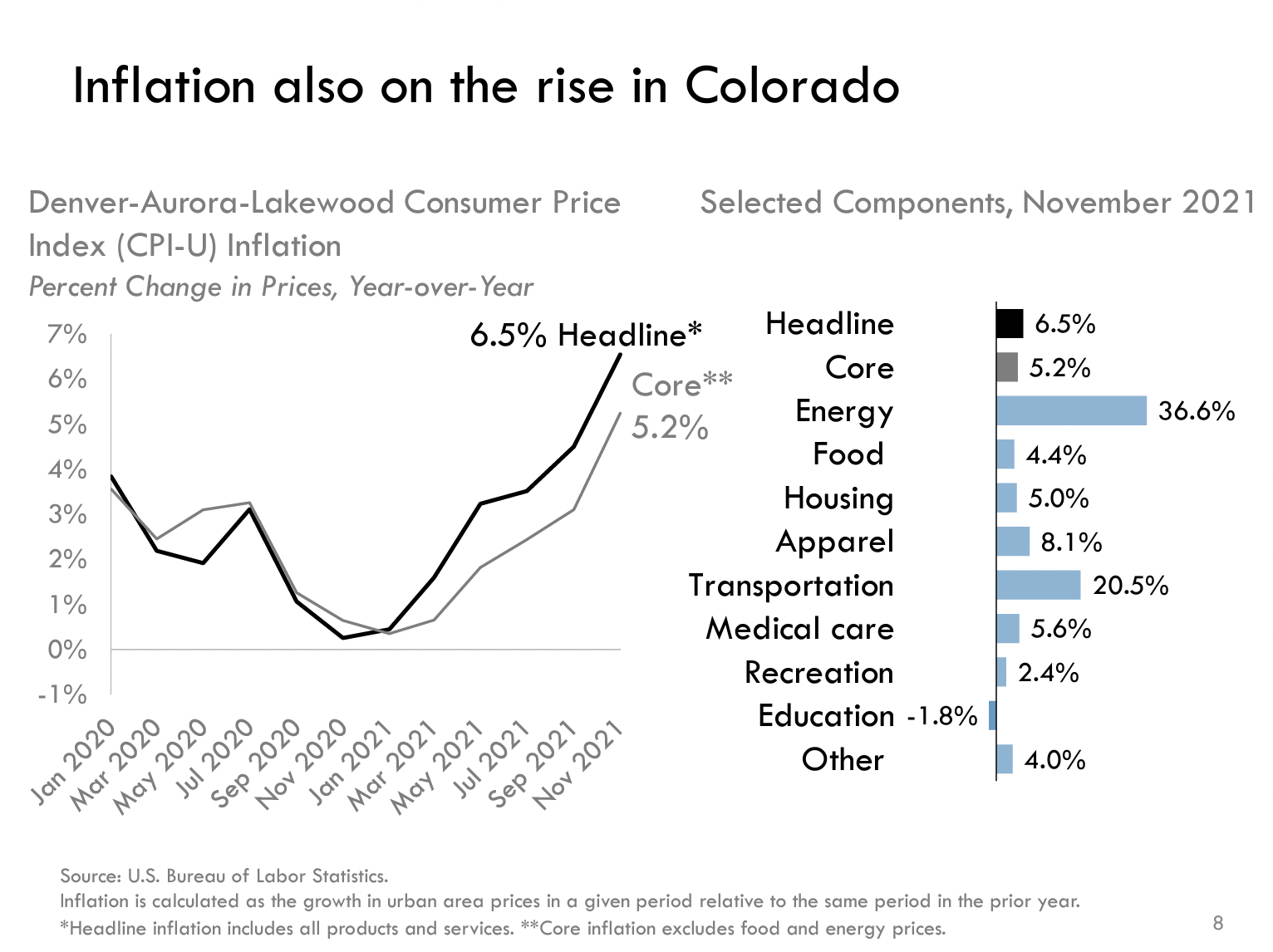

Inflation has been on the minds of almost everyone in the nation recently. With the cost of everything from groceries to gasoline increasing at an unprecedented rate, the issue is hard to miss. Inflation was front and center as the Joint Budget Committee (JBC) of the Colorado General Assembly heard the March quarterly revenue forecast.

The March forecast on the health of the Colorado economy is always an important one because it represents a final check before Colorado legislators embark on the approval process for the new fiscal year state budget. Committee members receive two forecasts. One is authored by the Legislative Council Staff (LCS) and the other comes from Governor Polis’s Office of State Planning and Budget (OSPB). All of the forecast documents are available online for both the LCS and the OSPB.

For CASB members the inflation number is doubly important since it is a key factor in establishing the dollars allocated to the School Finance Act (SFA). The brief take on the state's economy is Colorado remains far ahead of other states, but significant risks to the overall health of the economy remain. Notably among these risks are the Russian and Ukrainian war, inflation outpacing wage growth, and ongoing issues with the nation's supply chains.

The lingering effects of the COVID health pandemic on Colorado’s employment rate have nearly recovered to pre-pandemic rates. The Centennial state's unemployment rate of 4.1% is well below the national average. Employees are also experiencing increases in their salaries. These gains are more than offset, however, by near record rates of inflation. Coloradans are paying more for energy, food, and housing. These price increases have worked to blunt some of the wage increases earned by workers. Members of the LCS referenced “high and persistent inflation” as a significant concern during the forecast period. State economists believe that inflation will continue to register at or above 7% for the remainder of 2022 with the OSPB staff stating:

"There is upside risk to the forecast as consumers are more tolerant of high inflation and dip into excess savings instead of reducing demand. Additionally, the Fed may be able to control inflation quickly, boosting confidence in the economy. However, there is more than offsetting downside risk to the forecast due largely to inflationary pressures."

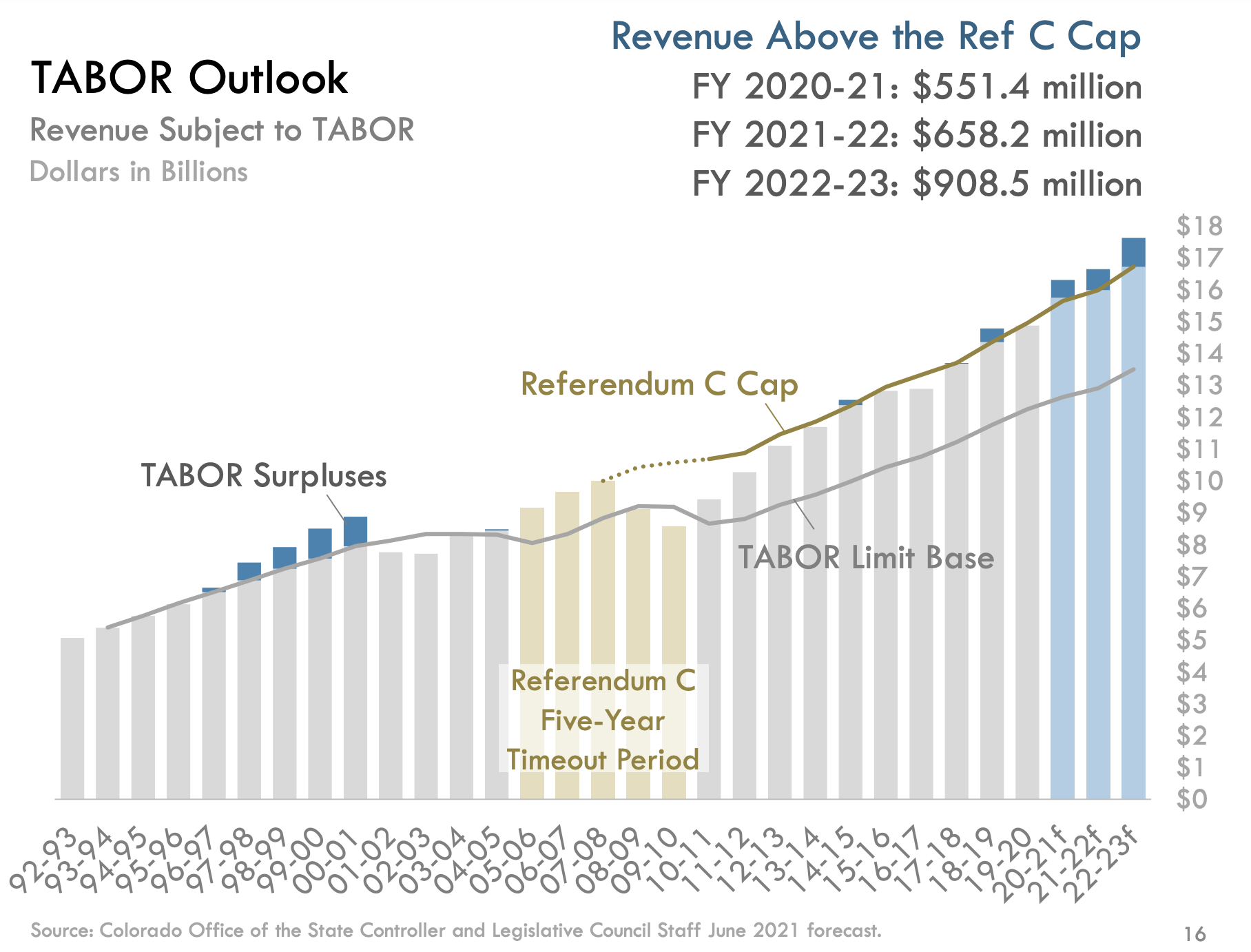

State tax collections continue to gain strength which in turn leads to taxpayer refunds under Colorado’s Taxpayer Bill of Rights (TABOR). Economists for the Legislative Council Staff are projecting TABOR surplus in excess of $2 billion for the current 2021-22 fiscal year. These funds are collected by the state but lawmakers are unable to save, spend or invest these funds.

More Money for Schools?

Colorado advocates for public education have tried multiple times to increase the amount of tax money available for Colorado classrooms. Since the passage of Amendment 23 in 2000 these efforts have failed. One phrase has proven to be hard for Colorado voters to see past, “Shall taxes be raised [...]”. Due to Colorado's so called Taxpayer Bill of Rights (TABOR), all measures on the ballot which would increase state taxes must include this phrase.

Now Colorado public school advocates are ready to attempt a different approach. A coalition of education groups working under the banner of Great Schools Thriving Committees (GTSC) would like to use a portion of the funds the state already collects and use it to improve schools. These TABOR surpluses are legally required to be refunded using a series of mechanisms. If voters approve the ballot measure a small percentage of TABOR surplus would be used to fund schools.

|

The first step in the process was accomplished when the state Title Board gave a green light to all four proposed initiatives submitted by the proponents. Poudre School District Board of Education member DJ Anderson is one of the people working on the issue. Following the Title Board hearing, Anderson had this to say.

“I am pleased that we were able to get a simple and clear title which I believe voters will be able to understand clearly. This brings us a step closer to providing the desperately needed funding for our public education system in Colorado.”

One of the proposed initiatives approved reads:

“Shall there be a change to the Colorado Revised Statutes concerning additional funding for preschool through twelfth-grade public education without raising taxes, and, in connection therewith, requiring revenue collected by the state from one-third of one percent of all federal taxable income of every individual, estate, trust, and corporation, as modified by law, to be deposited in the state education fund; allowing the additional revenue to be spent by the state and local school districts as a voter-approved revenue change; requiring the additional revenue to be used for attracting, retaining, and compensating teachers and student support professionals; specifying appropriations of the additional revenue do not supplant existing appropriations for public education; and requiring an annual report describing the allocation of the additional revenue?”

Lisa Weil, the Executive Director of Great Education Colorado, shares, “Because of our rebounding economy, this measure gives us a once-in-a-generation opportunity to help districts attract, retain, and pay teachers and other student support professionals without raising taxes and would give Colorado a way to start repaying the decade-old debt of the B.S. ("Borrowing from Students") factor.”

We expect that there will be a number of measures on the 2022 ballot that could permanently slash income, sales, and property tax revenues. That makes it all the more critical to give voters the chance to protect and strengthen school funding and tell educators: "We see you, we appreciate you, and help is on the way."

CASB staff will share additional details as they develop. Make sure to follow our social media channels for the latest information.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

December Quarterly Revenue Forecast

The General Assembly will start their work on Wednesday, January 12, 2022, but the real start of the legislative session kicked off with the December quarterly revenue forecast to the Joint Budget Committee (JBC). Quarterly, the JBC receives revenue forecasts from two state departments, the Legislative Council Staff (LCS) and the Governor’s Office of State Planning and Budget (OSPB). As has been the case during much of the COVID health pandemic, the forecasts offer some good news with a big dose of caution. The LCS December revenue forecast is available here and the OSPB forecast is available here for your review.

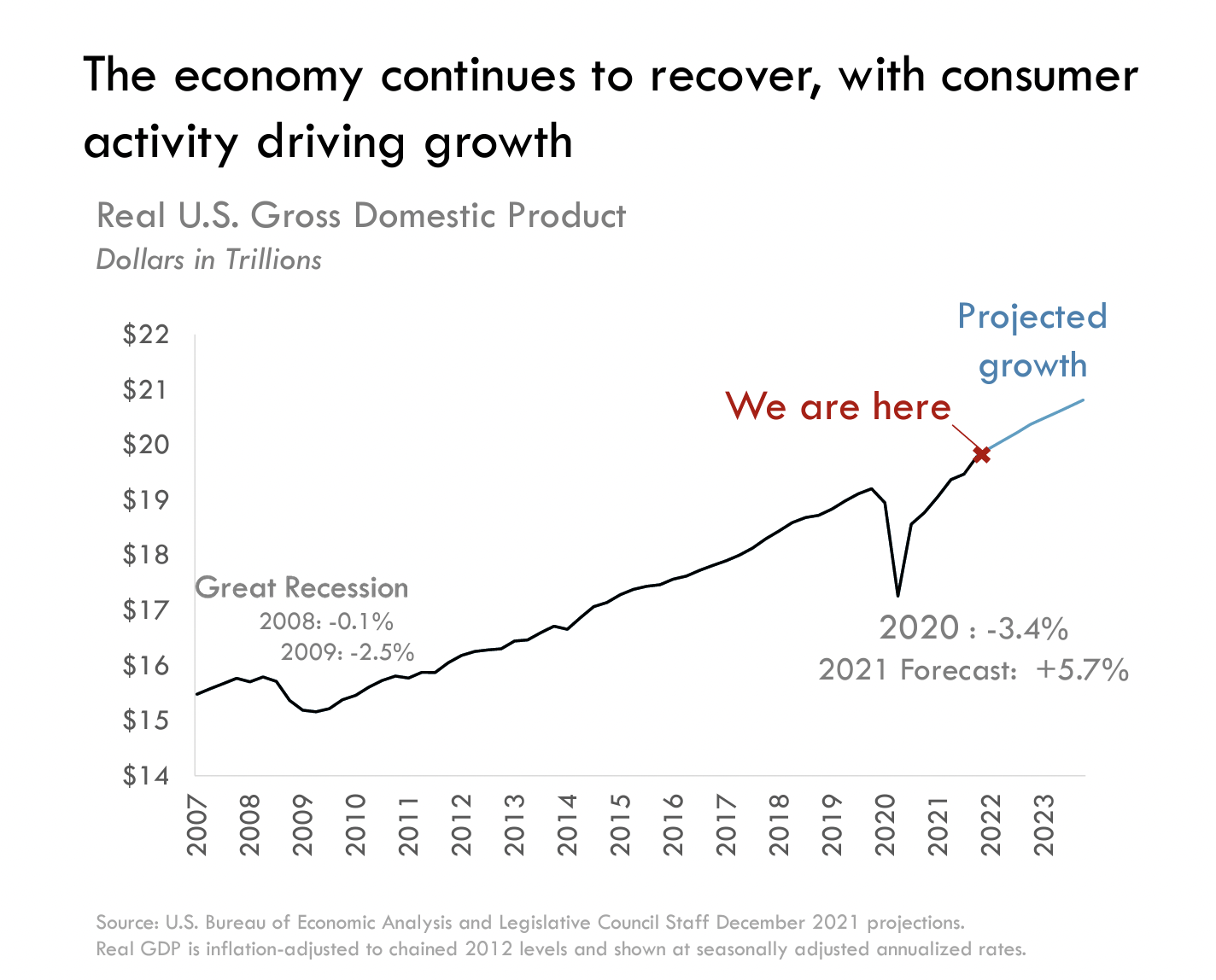

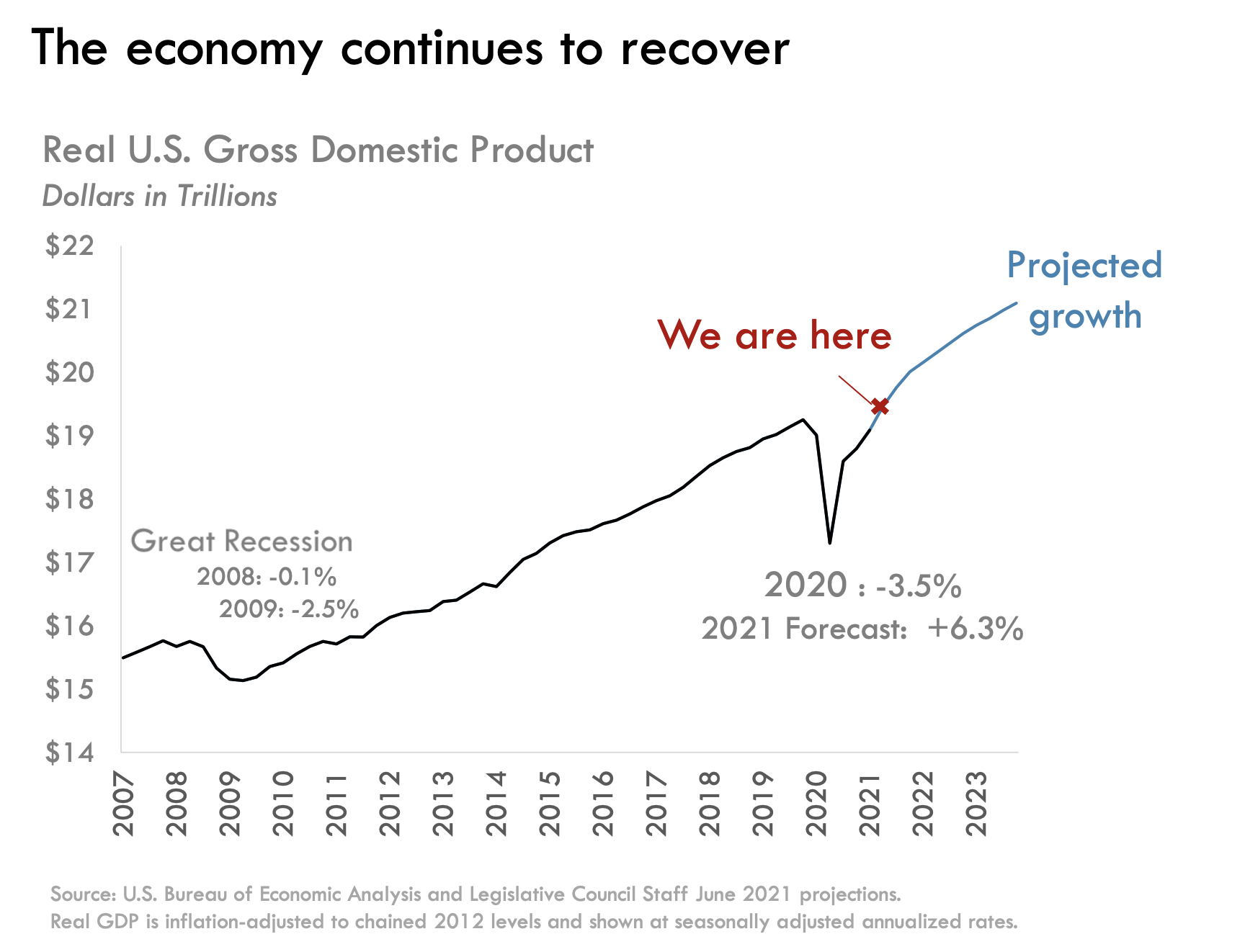

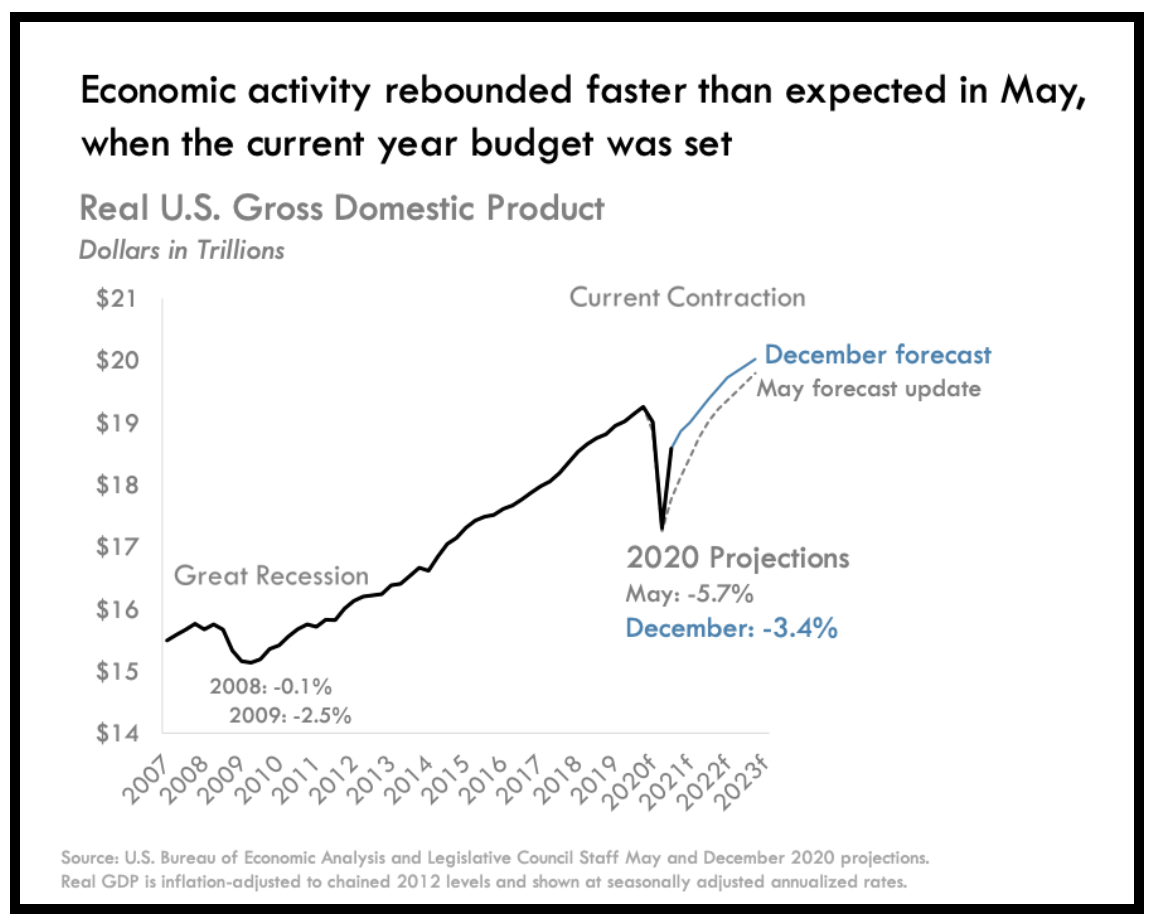

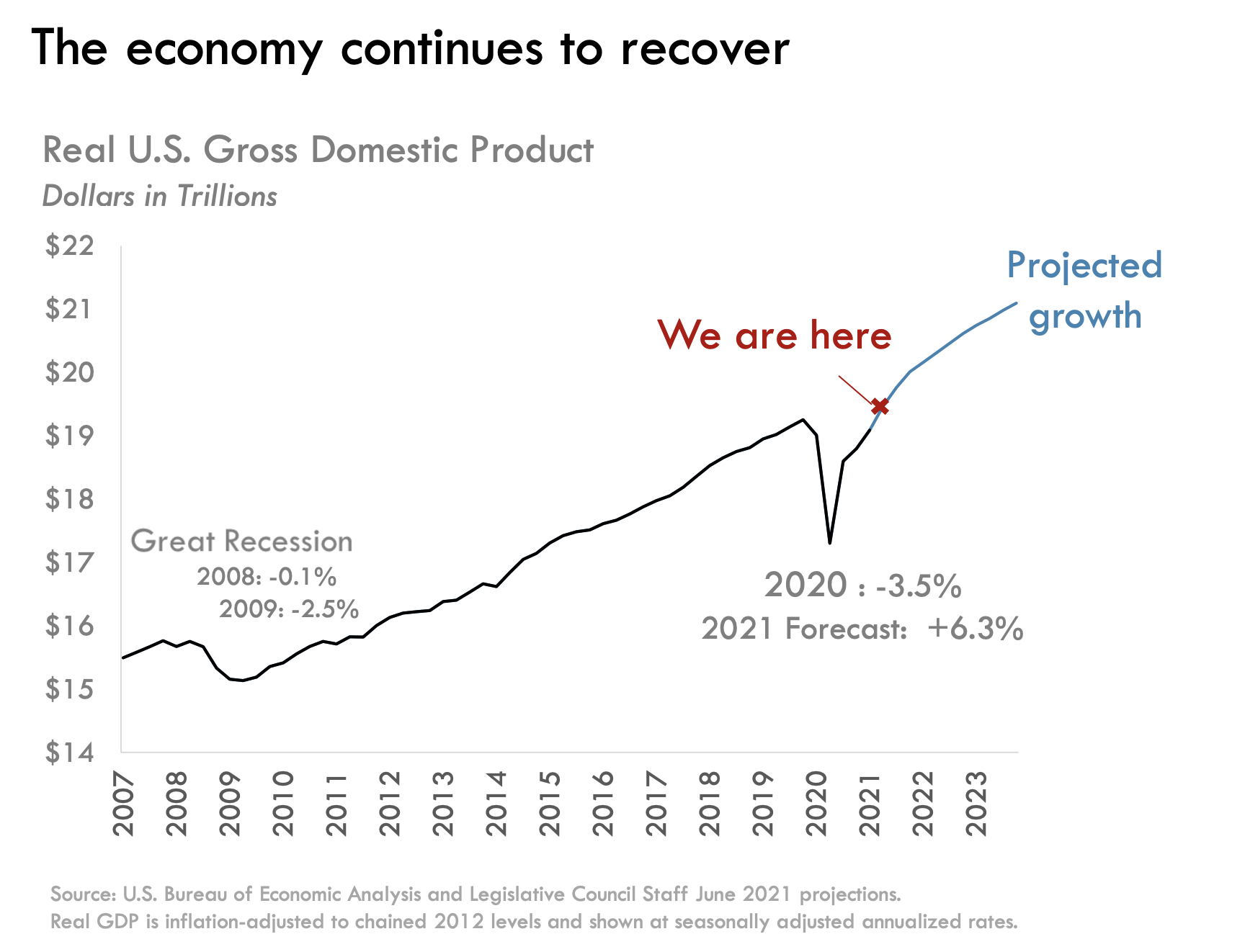

The Colorado economy mirrored the U.S. economy in continuing to rebound from the economic disruptions caused by the COVID health pandemic. The slide below highlights the strength of the uptick.

|

While the increase in economic activity is strong, inflationary pressures are increasingly dragging on those gains.

|

|

The LCS report highlights inflation as one of several factors that remain a risk to the ongoing growth of the economy. These items include:

- Supply chain disruptions

- Supply chain problems have had significant impacts on many industries in the state.

- Labor shortages

- Ongoing effects of the COVID virus

Additionally, the state will be required to refund approximately $450 million under the Colorado Taxpayer Bill of Rights (TABOR). This represents tax revenue already collected by the state but funds that are not legally allowed to be spent by the legislature because they exceed the limits imposed by TABOR.

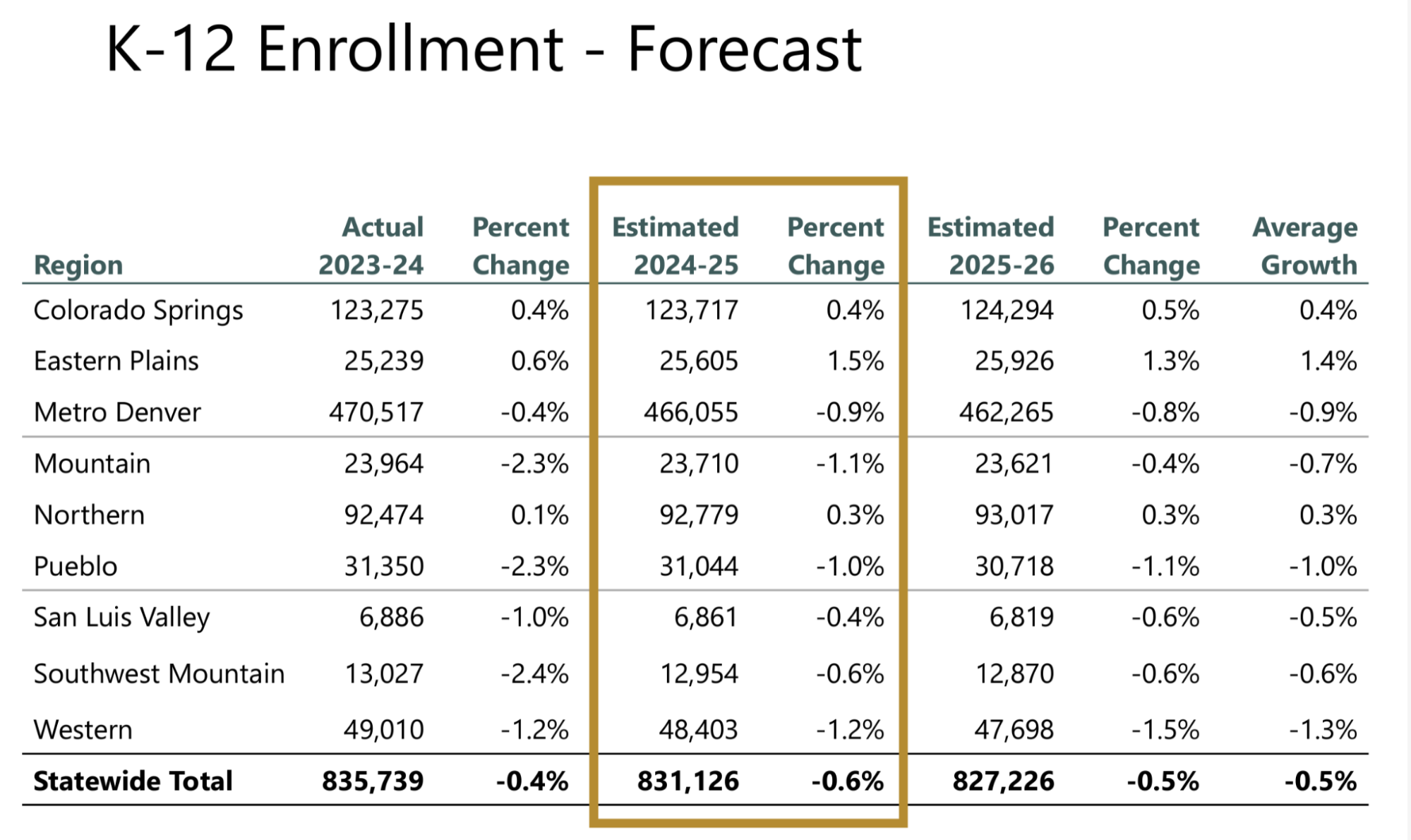

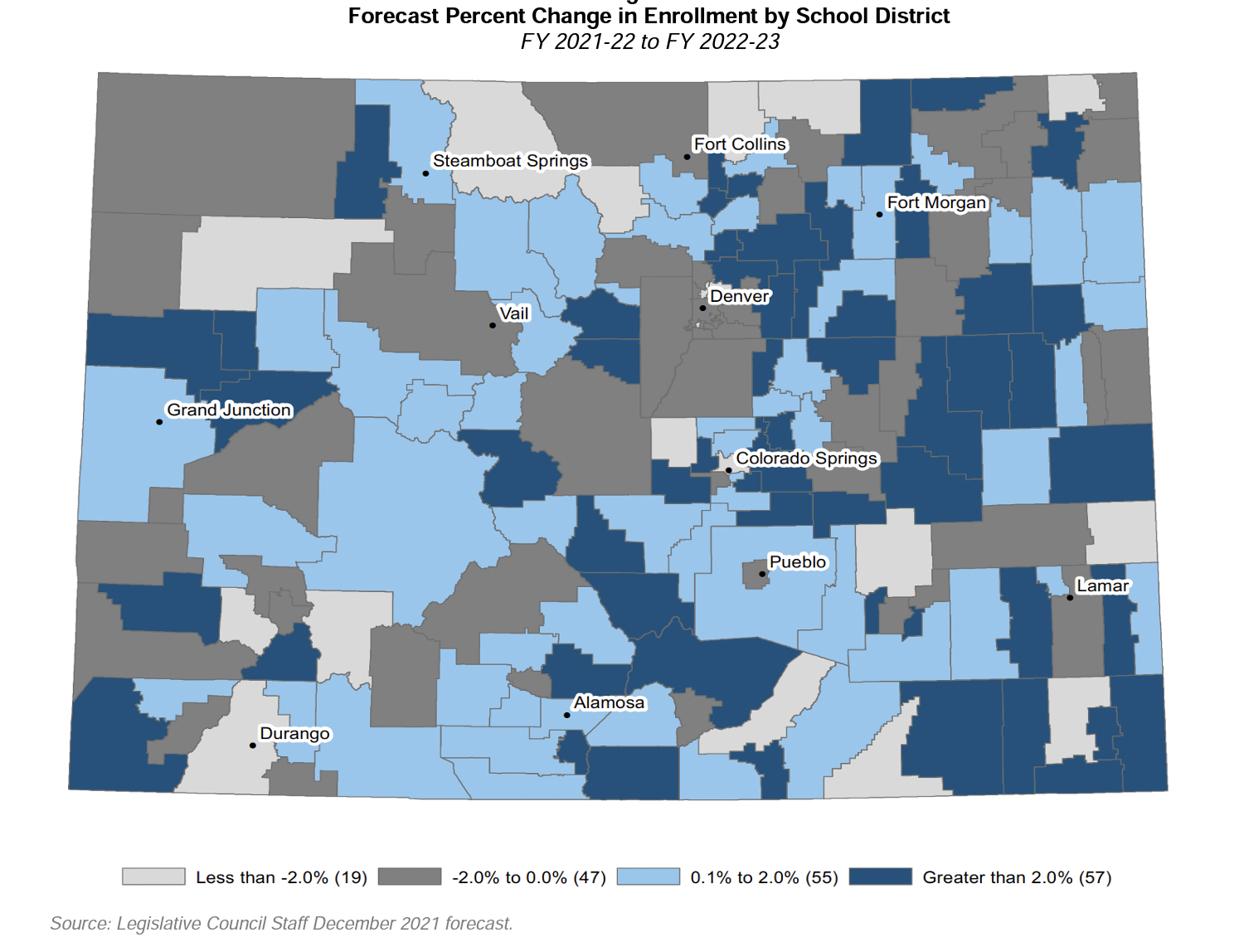

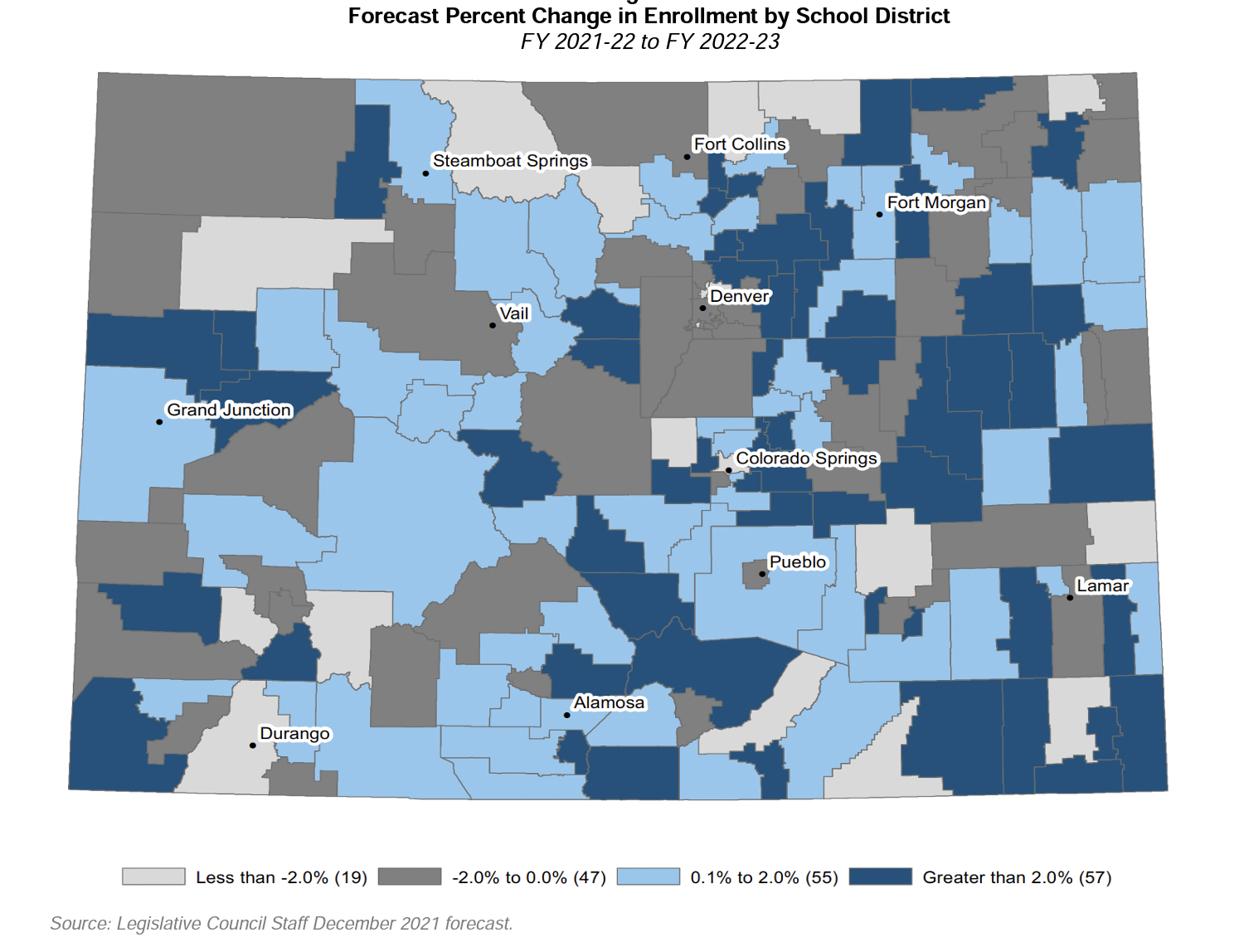

CASB members will note that all of these impacts will factor into K-12 education funding. Student enrollment in 2021-22 is projected to decrease by more than 2,600 students. Including this decline in enrollment, the state economists are projecting a decrease of 25,596 fewer students than were originally forecasted in the December 2020 revenue forecast. Student enrollment has increased in some parts of the state, while significantly decreasing in other parts of the state.

|

|

An additional component important to Colorado School Finance is the Assessed Valuation of Residential and Non-Residential property. Legislative Council Staff is projecting a 4.4% increase in Assessed Valuation. This calculation includes more robust increases in Residential property values offsetting lower Non-Residential rates due to less demand for commercial property due to the COVID pandemic.

The December revenue forecast provides information to legislators as they begin to craft a state budget. However, it is important to keep in mind the information presented is a projection of potential revenue. As stated in both forecasts, there are a number of economic issues that could significantly change the amount of funding with which the General Assembly has to work. The budget is usually adopted by the General Assembly in late spring following the March Revenue forecast. Your CASB staff will be providing additional information as we move into the new year.

Look for the return of the School Board Advocate in January. The School Board Advocate is published on the second and fourth Friday of each month during the session. Additionally, CASB staff would like to encourage you to attend the 2022 Winter Legislative Conference — February 24 and 25, 2022 in Denver. This is a great opportunity to educate yourself on important legislative topics, network with fellow CASB members, and most importantly meet with your legislators to share your insights on the critical issues facing public education.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

Gov. Polis’ budget request for FY 2022-23

The Governor annually submits a budget request to the Joint Budget Committee (JBC) of the General Assembly in November. While the Governor’s budget proposal is an important document to outline the priorities of the current administration, it does not always resemble the final budget adopted by the Colorado legislature.

Gov. Jared Polis has proposed a 2022-23 budget that he said is intended to “save people money and protect the Colorado way of life.”

For this year the main elements include what he calls “fiscal responsibility” measures intended to protect the state budget against revenue downturns in future years and a package of one-time investments.

Key fiscal responsibility measures include a 15 percent General Fund reserve and $1.84 billion prepayment of some future state expenses.

The major elements of the $1.2 billion of one-time spending are K-12 education, lifting of some individual and business fees, workforce investments, unemployment insurance premium relief and investments in public safety, air quality and maintenance of state assets.

The Office of State Planning and Budget (OSPB) summary follows:

“The FY 2022-2023 budget includes total General Fund expenditures of $17.2B, which represents an increase of $2.3B, or 15.6% over FY 2021-2022 enacted, … . This $17.2B includes $13.3B within agency budgets, $2.0B for a 15% reserve, $1.5B for one-time state investments, $1.3B for TABOR refunds, $374.1M for capital construction, and $446.4M of transfers and expenditures not subject to the appropriations limit and reserve requirement. This budget is balanced, with a projected ending General Fund balance of $2.3B which is sufficient to support the 15.0% required reserve level.”

Key proposals in the plan

A summary of major administration priorities includes:

- 15 percent reserve - $1.99 billion

- Buy-down of K-12 Budget Stabilization Factor (BSF) of $150 million. That would reduce the BSF to 4.7 percent; state funding for K-12 would increase $381.2 million. And $300 million would be taken from the prepayment category and put into the State Education Fund and another $100 million will be included for the BEST Program.

- Prepayment of future costs - $1.83 billion. This includes a three-year state employee compensation package under the new collective bargaining agreement

- Fee relief - $103.9 million. This includes state payment of some fees for business incorporation, health care professional licensing and reduction of employer and employee premiums for the FAMLI leave program.

- UI trust fund fee relief - $500 million. This will delay premium increases and put funds directly into the trust fund. To be supplemented with $100 million ARPA funds.

- Public safety package - $45 million GF plus about $68 million in other funds for law enforcement training, increase the CBI, grants for local public safety projects and more funding for homelessness response. This priority also includes funding for state and local transportation improvements.

- Air quality - $424.3 million for everything from buying electric school buses to money for environmental efficiency in the marijuana industry to more money for air pollution regulation.

- State capital investments - $314.9 million, including $30 million for daycare centers in up to 15 state facilities.

- The proposal includes a $13 million placeholder ($5.1 million General Fund) to fund the new Department of Early Childhood.

- A $442.6 million increase in higher education operating funding and an increase of $9.8 million for financial aid.

- Behavioral and physical health improvements including $10 million for DHS to hire about 100 staff to serve 44 new forensic beds at Fort Logan.

- $175 million for affordable housing initiatives.

The Governor’s budget proposal is available on the state Office of Planning and Budget website. CASB staff will provide a further analysis in the upcoming School Board Advocate.

|

Election Day messages you can share with your networks

It’s finally here — Election Day 2021. As there are several initiatives on the ballot that would influence K-12 education and on which CASB Delegates took positions (visit the website to learn more), we have some prepared messages you can use on social media to remind others to vote.

- Happy November! It's time to drop off your ballot if you have not yet voted. It's too late to mail your ballot, but drop boxes are open until 7:00 p.m. GoVoteColorado.com provides details.

- Visit the CASB website to learn more about several statewide ballot initiatives that affect schools.

- Ballots are due by 7pm on Tuesday, Nov 2. GoVoteColorado.com provides answers to common questions.

- Today is the last day for public education advocates to get their ballots in. Colorado students are depending on us!

CASB will send out an election recap once the dust settles.

|

Colorado Association of School Boards

2253 S. Oneida St., Suite 300

Denver, CO 80224

303-832-1000

|

|

June 18, 2021

June revenue forecast — strong revenue growth and TABOR refunds

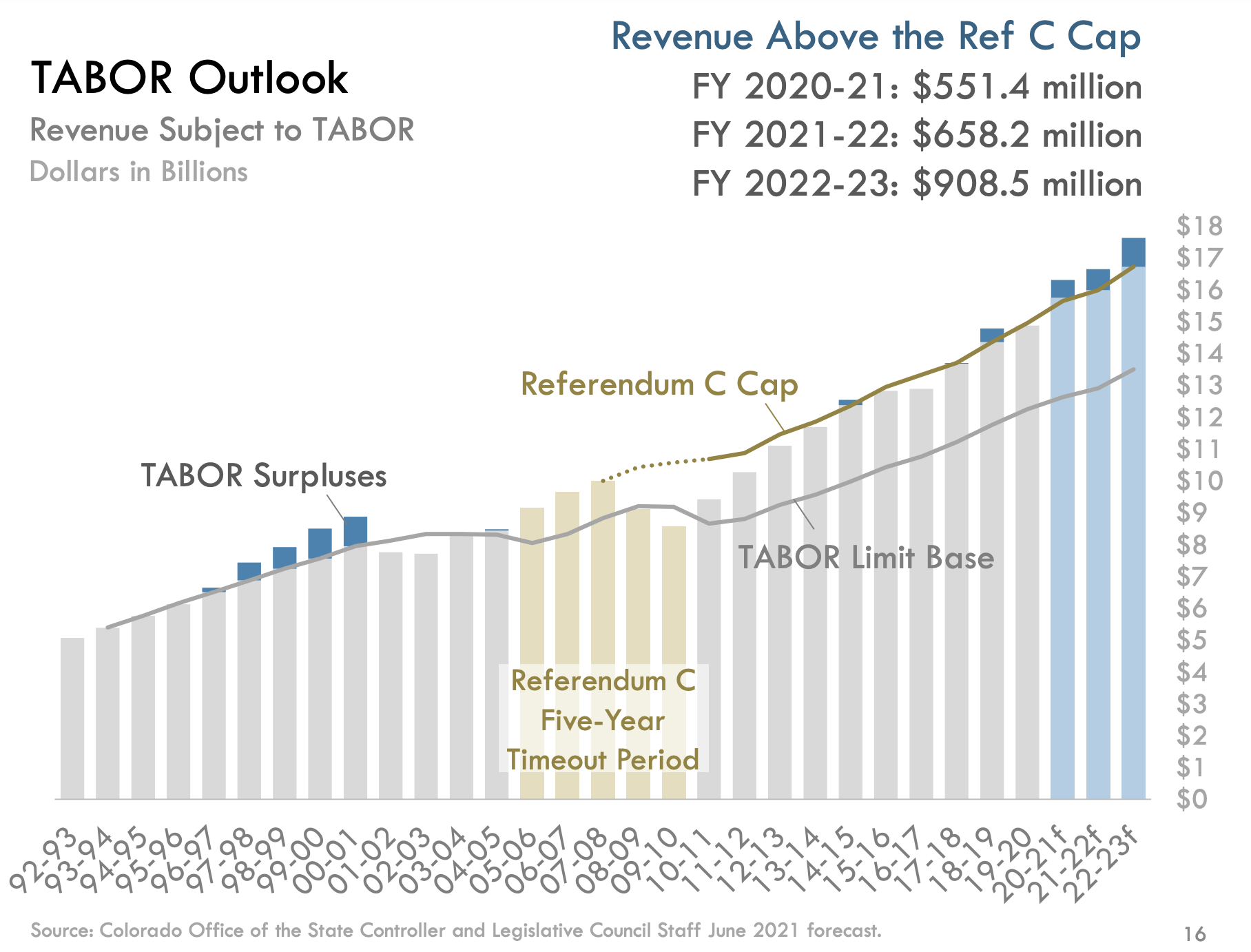

The June revenue forecast was released on Friday, June 18. State revenues have been growing more strongly than forecasted in March — the growth has been so strong that TABOR refunds will be required for the 2020-21, 2021-22 and 2022-23 budget years. The following slides are from the Legislative Council Staff presentation.

A few highlights from both the Legislative Council Staff (LCS) and Office of State Planning and Budgeting (OSPB) presentations to the JBC:

LCS

- Retail sales have surpassed pre-recession levels and leisure and hospitality are catching up

- 66 percent of lost Colorado jobs have been recovered

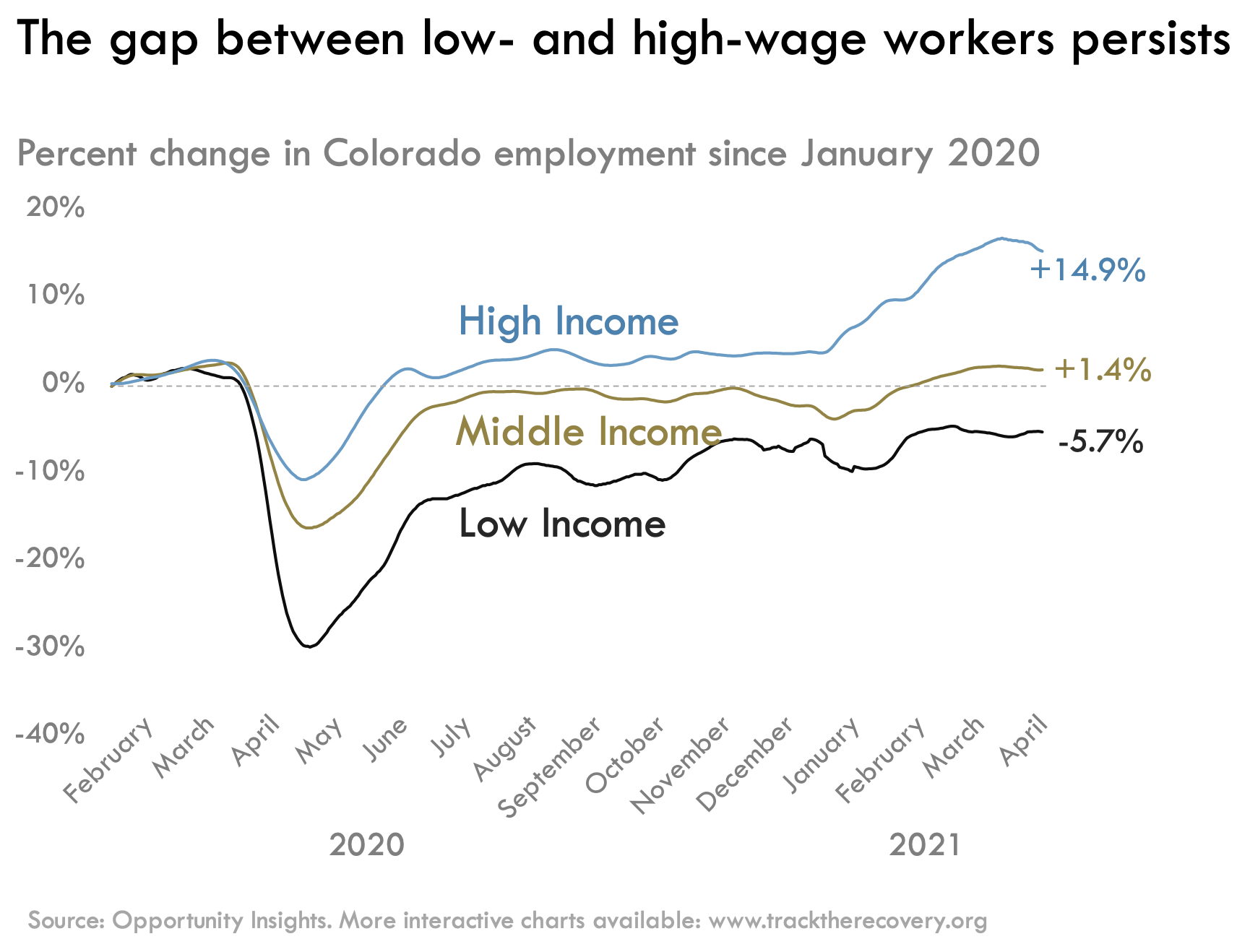

- A continuation of the gaps between high- and low-income earners

- Federal stimulus payments created overall income gains, but those effects are waning

- Inflation has increased, but that may be temporary

- Forecast risks remain high, both positive and negative

OSPB

- The economy continues to improve but employment is lagging

- Colorado is outpacing the nation in people returning to work

- Inflationary increases are temporary

- Agrees that risks to the forecast remain high

You can access the presentations at the following links:

May 28, 2021

HB21-1325, Funding Public Schools Formula, would change school funding formula

With less than two weeks to go in this year's legislative session and with the looming deadline for school districts to set their budgets for next year, a new bill HB21-1325, Funding Public Schools Formula, was introduced yesterday. The bill summary and fact sheet from the bill sponsors — Reps. McCluskie and Herod / Sens. Zenzinger and Rankin — state the following:

Beginning in the 2021-22 budget year:

- Adds students eligible for reduced-price lunch to students who are eligible to receive at-risk funding.

- Removes English Language Learners (ELLs) from the current definition of at-risk pupils and creates a new funding factor to the formula equivalent to 8 percent of per pupil funding multiplied by ELL enrollment.

- Creates the Legislative Interim Committee on School Finance, which will meet during the 2021 and 2022 legislative interims and the 2022 and 2023 legislative sessions as necessary. The committee consists of four senators and four representatives, and must consider issues including: the current and alternative methods for identifying economically disadvantaged students, the appropriate methods to address district cost of living and small, remote and rural school district funding and funding equity related to revenue collected from total program mill levies and voter-approved mill levy overrides.

Beginning in the 2022-23 budget year:

- Creates the Mill Levy Override Match Fund and directs the Department of Education (CDE) to calculate a match amount for any school district that levies 27 total program mills and that would have to levy more than 30 mills to reach the maximum amount of mill levy override revenue permitted.

Worth noting, a fiscal note is forthcoming and will be added to the Legislative Alert on the website once it is available. If approved HB21-1325 will change the allocation of the additional resources provided through HB21-1164, Total Program Mill Levy Tax Credit (as covered in the May 24 Legislative Alert).

CASB will keep you updated and stay tuned for digital advocacy alerts as we enter the final days of this legislative session.

May 24, 2021

Colorado Supreme Court rules on HB21-1164, Total Program Mill Levy Tax Credit

In one of the most anticipated rulings in recent memory, the Colorado Supreme Court has ruled that HB21-1164, Total Program Mill Levy Tax Credit, is constitutional and does not violate the Colorado Taxpayer Bill of Rights, or what is commonly referred to as TABOR. This clears the way to restore some semblance of balance between state and local funding for schools.

This decision has been a long time in the making so some background information may be helpful. In 1992, Colorado voters approved TABOR, which limits the creation of new taxes or tax increases without the approval of voters. Starting in approximately 1994, local school districts went to their voters to ask if the school district could retain tax revenue that was already being collected when that revenue came in above the TABOR-mandated limits. This is referred to as “debrucing” and has been a common practice. In fact, 51 out of the 64 counties in the state and 230 out of the 274 municipalities in Colorado have all debruced since TABOR’s inception in 1992. Of the 178 school districts in Colorado, 174 were successful in debrucing, (obtaining voter approval to allow them to retain the additional taxes). However, the Colorado Department of Education (CDE) erroneously lowered mill levies despite voter approval to debruce.

Fast forward to 2009 when the Colorado Supreme Court agreed to hear a case now commonly referred to as the “Mesa case”. The case involved the County Commissioners of Mesa County and several other entities, including CASB, asking the Court to rule on the validity of the CDE directive regarding local property mills. In the Mesa case, the Colorado Supreme Court ruled that the CDE had acted erroneously in telling school districts, whose voters had approved the district to retain tax revenue above the TABOR limits, to lower their mill levies. Since 2009, the Colorado General Assembly had not created a bill to address the problem with local property mills, so the issue remained unresolved.

HB21-1164 requires CDE to adopt a schedule to correct the problem brought forth in the Mesa case and to apply it evenly across the state. The bill calls for mill levies to not increase more than one mill per year until they reach 27 mills or full funding of the local share. HB21-1164 has been “on-hold” in the Senate awaiting the ruling from the Court. The bill passed out of the Colorado House in mid-March along largely party lines. An amendment added to the bill in the House requires the General Assembly to allocate any new funding raised to be used for education as long as the Budget Stabilization factor is in place. This is the text from the official legislative description of the bill:

“The bill specifies that, until the general assembly determines that stabilizing the state budget no longer requires a reduction in the appropriation for the state share of total program, the general assembly shall annually ensure that the savings to the state share that occurs as a result of the decrease in the temporary property tax credits is appropriated to fund a portion of the state share of total program.”

The revised fiscal note on the bill - Appendix B - provides the estimated additional funding to each district under the new schedule. The bill will provide approximately $90 million in funding for the 2021-22 fiscal year and funding will be distributed through the School Finance Act. HB21-1164 was passed today and is awaiting signature by the Governor.

May 12, 2021

School Finance Act is introduced

The Colorado General Assembly has introduced the School Finance Act (SFA) for the 2021-22 school year. SB21-268 this year is sponsored by Senators Rachel Zenzinger and Paul Lundeen. This year's version of school finance is poised to move quickly as the General Assembly works to wrap up the 2021 Legislative Session.

Of note to CASB members are:

-

Inflation changes increase per-pupil funding by $141.67 for a base per-pupil funding of $7,225.28

-

Returns the Budget Stabilization (BS) Factor to pre-COVID pandemic levels at $572 million

-

Increases funding for At-Risk students by including students who receive “reduced” school lunch as well as the currently funded students who receive “free” school meals

-

Additional funding for English Language Learners (ELL) students is included in the bill

-

Section 12 of the bill extends the timeline local boards of education have to adopt a budget for the 2021-22 fiscal year.

(a) A board of education shall prepare and submit a proposed budget in accordance with section 22-44-108 not later than June 23, 2021;

(b) After submission of a proposed budget, but not later than June 25, 2021, the board of education shall publish a notice of proposed school budget.

The bill includes the restoration of funding for several grants that were cut in the 2020-21 SFA. These include:

-

$800,000 and 0.6 FTE for the ninth-grade success program;

-

$375,807 for the school leadership program;

-

$280,730 for the accelerated college opportunity exam fee grant program; and

-

$250,000 and 0.3 FTE for the John W. Buckner Automatic Enrollment in Advanced Placement Courses Grant Program.

Included in the bill is the removal of the cap on the counselor grant program and makes available $2 million to fund the grant. As CASB members know counselors have played an even greater role in students’ lives during the COVID health pandemic.

CASB is closely monitoring and evaluating the following provision that would grant the State Board of Education the authority to override a local board’s proposed revisions to an existing innovation school or innovation zone plan.

Section 14:

THE STATE BOARD SHALL REVIEW AND ACCEPT OR REJECT A LOCAL SCHOOL BOARD'S PROPOSED REVISIONS TO AN EXISTING INNOVATION SCHOOL OR INNOVATION ZONE PLAN. THE STATE BOARD'S DETERMINATION MUST BE BASED ON SERVING THE BEST INTERESTS OF STUDENTS, FAMILIES, AND THE COMMUNITY.

Legislators also included a moratorium on Boards of Cooperative Education (BOCES) from opening a physical school in a school district that has not authorized such a school. Recently, CASB was alerted to a situation involving the Education Reinvisioned BOCES (ER BOCES), which has established a new pathway to open brick and mortar public schools located in school districts that are not part of the BOCES without consulting or receiving district consent. A recent court case ruled in favor of the ER BOCES, based on language in Colorado law that essentially creates a loophole. Given the ambiguity in the current statute, Section 16 of the bill expressly states that a BOCES that intends to locate or operate a BOCES school within the geographic boundaries of a school district that is not a member of the BOCES during the 2021-22 school year to obtain written permission from the school district in which the school will be operated or located.

The bill is scheduled to be heard in Senate Education on Thursday, May 13, at 1:30 pm. The committee hearing audio is available online and remote testimony is available by signing up at this link.

March 19, 2021

March revenue forecast

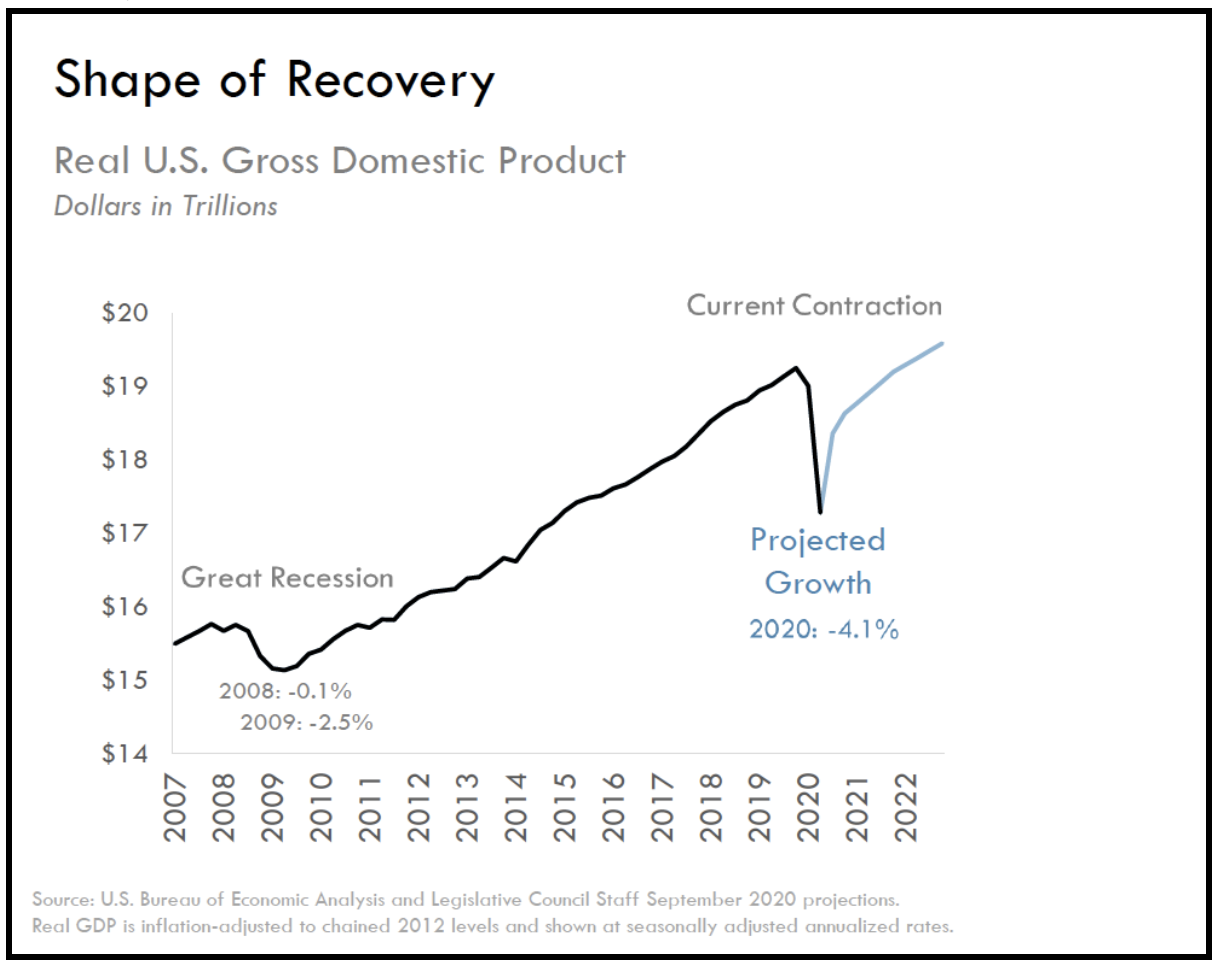

Prior to the COVID health pandemic, the Colorado economy was among the best in the nation. Then, approximately one year ago, the restrictions related to the health pandemic began to kick in and the economy ground to a halt. Now, a year later, it appears the strength our state's economy possessed prior to the pandemic has helped it weather the effects of the pandemic.

The Colorado General Assembly’s Joint Budget Committee (JBC) received the March 2021 quarterly revenue forecast on Friday March 19, 2021. The JBC receives two separate forecasts, one from the Legislative Council Staff (LCS) and the other from the Governor’s Office of State Budget and Planning (OSPB). The forecast documents are available here for the LCS and here for the OSPB.

In March 2020, state economists predicted significant issues with the then unknown impacts of the COVID-19 virus. The Colorado General Assembly during the shortened 2020 Legislative Session took steps to cull the budget to account for these projected reductions. This budgetary belt tightening has put the state in a much better position one year later as the state continues its recovery from the COVID-19 health pandemic. While the economy is not anywhere near as robust in 2021 as it was in pre-COVID 2020, it does appear the worst of the COVID-19 related recession is behind us. The Legislative Council Services forecast highlights:

“For broad measures of U.S. and Colorado economic activity, the worst chapters of the pandemic-induced recession appear to be behind us. The U.S. Food and Drug Administration has now approved emergency use authorization for three vaccines effective against the virus that causes COVID-19, and the number of Americans immunized against the disease is growing daily. With vaccine distribution in full swing, confidence among businesses and consumers is on the rise. The labor market recovery lost some of its momentum toward the end of 2020, but the most recent figures suggest that employment has begun to grow again, albeit modestly, to begin 2021.”

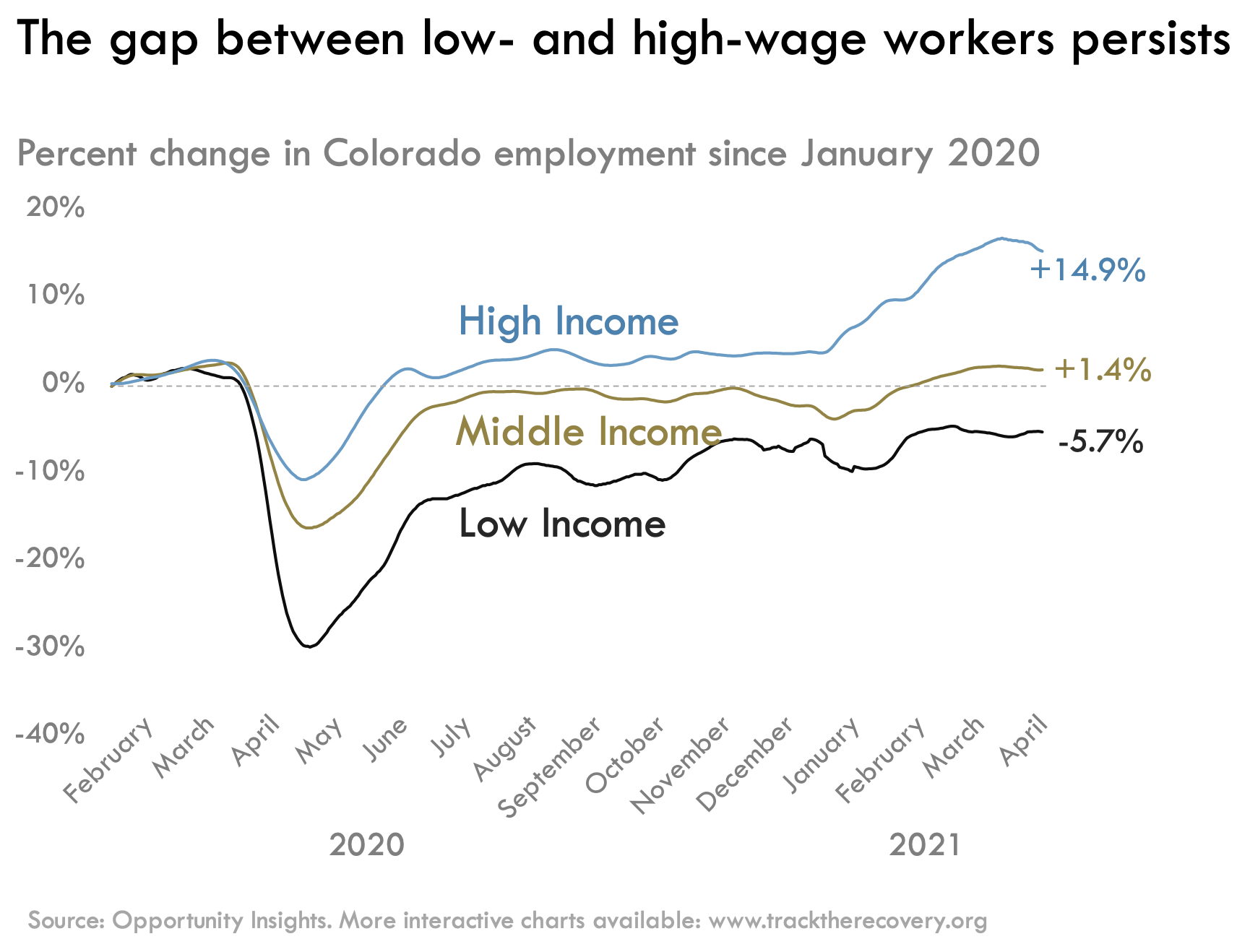

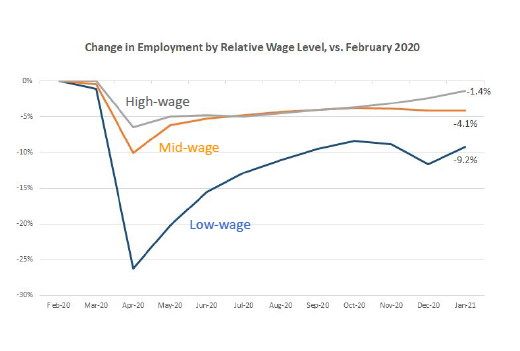

Unfortunately, the overall economic good news is not applied equally across all areas of the state. While high-wage employment is at pre-recessionary levels, low-wage workers remain severely impacted. This chart from the OSPB forecast presentation provides evidence of this disparity.

Significant decreases in the restaurant and tourism industries remain high. Coloradans who work in these industries have borne the brunt of this ongoing decline with heavily reduced wages and much higher unemployment rates.

Both the forecasts from the LCS and the OSPB projected significant risk to the state's economic future. These risks include higher than expected inflation, unknowns in federal monetary policy and the potential impacts of virus variants that are resistant to current vaccines.

What does this all mean for CASB members as they finalize school budgets in the coming months? It depends on who you ask. Many feel that the good economic news and influx of federal relief funds should help schools land in a good spot as they continue — or return to — in-person learning. Others believe that the ongoing structural problems with how Colorado allocates funds to education will only exacerbate the current problems schools face.

The 2021-22 budget and school finance act will come into better focus in the coming weeks as the JBC and the full General Assembly get to work on the state budget — also referred to as the Long Bill — and the School Finance Act. The schedule for this action is:

- Week of March 22 — the JBC finalizes the Long Bill

- Week of March 29 — the Long Bill will be debated in the Senate

- Week of April 5 — the Long Bill will be debated in the House

- Week of April 12 — the JBC reconciliation, House and Senate floor votes, and bill sent to the Governor

The CASB website provides several ways to track bills and we encourage you to follow CASB social media channels for the latest updates.

Legislative updates

CMAS suspension for select grades (HB21-1161)

This week the Colorado General Assembly passed, and Governor Polis signed, HB21-1161 — Suspend Statewide Assessments For Select Grades. The bill would request to suspend some elements of the state CMAS testing. The Colorado Department of Education (CDE) has sent the waiver — as called for in the bill — to the U.S. Department of Education and are awaiting their response. CASB is asking education advocates across the state to contact your member of Congress and request their support for the waivers. Follow this link for all the details and take action today.

Potential changes to mill levy calculations (HB21-1164)

In another significant move, the Colorado House of Representatives approved HB21-1164 — Total Program Mill Levy Tax Credit and sent it to the Senate. The Senate passed the bill on second reading and also introduced Senate Joint Resolution 21-006 titled “Interrogatory Regarding School District Mill Levies”. The resolution, if approved by the General Assembly, would request the Colorado Supreme Court to weigh in on the issue of how property taxes for public education are levied.

HB21-1164 would attempt to remedy a decade-old mistake by the CDE in how mill levies are calculated for schools. The case, known as the “Mesa case,” provided an opinion from the Colorado Supreme Court that CDE had incorrectly directed Colorado school districts to assess a lower number of mills. This decision by CDE was made even after the vast majority of Colorado school districts’ voters had approved a measure to allow school districts to keep revenue collected above the Colorado Taxpayer Bill of RIghts (TABOR). This complex issue is one that we encourage CASB members to learn more about. This Chalkbeat Colorado article provides some background on the issue. The CASB Delegate Assembly has a long history of supporting restructuring of Colorado Constitutional tax code.

Correction to School Board Advocate from March 12, 2021

The following statement was corrected in the “CMAS clock ticking” article in last week’s School Board Advocate:

...the USDE also released a template to assist states in applying for waivers in regards to some aspects of accountability reporting for the Every Student Succeeds Act (ESSA). Given how quickly the testing window is approaching, anxiety is rising for school districts. CASB staff will keep you posted as details unfold.

Click here to access the School Board Advocate (member login required)

December 22, 2020

Congress approves additional COVID relief

Congress has approved additional COVID relief that will assist with the impacts caused by the current health pandemic. Of note for CASB members:

$82 billion for education overall

- $23 billion for higher education

- $4 billion for the Governor Emergency Relief Fund. This includes a set-aside for private K-12 schools

- $54 billion for K-12 public schools. There is no condition related to funding based on schools physically reopening and operating with in-person education

A few other areas worth highlighting include:

- $250 million for Head Start.

- $10 billion for the Child Care and Development Block Grant (CCDBG).

- $7 billion to increase broadband access.

- $3.2 billion in emergency funds for low-income families to access broadband through "an FCC fund” which appears to be a new program. This will have some positive impact on some students but will force them to compete with other interests for the funding.

- $1 billion for a tribal broadband fund.

- $65 million to complete broadband maps pursuant to the Broadband DATA Act approved earlier this year.

There is no dedicated funding to connect the millions of students impacted by the homework gap. Originally, there was $3 billion proposed that would have been run through the E-Rate program.

The bill is expected to be signed by the President. Details about how quickly the funds will be made available are expected in the coming weeks.

Also worth mentioning: the deadline for spending down funds through the CRF has been extended from December 31, 2020 to December 31, 2021.

General Assembly delays start

The Colorado General Assembly announced this week a delayed start to the 2021 Legislative Session. Per a media release, the House and Senate will convene on Wednesday, January 13, 2021 to address legally required actions and then adjourn until approximately mid-February. It is hoped that the delay will provide time due to the current spike in COVID cases to subside. Your CASB staff will have additional details after the winter holidays.

U.S. Secretary of Education Candidate

President-elect Joe Biden is expected to nominate Miguel Cardona as the next U.S. education secretary. Miguel Cardona is the head of Connecticut's public schools and has spent his career in education as an elementary school teacher, principal, and assistant superintendent, before taking on the role of top education official in Connecticut.

Cardona’s background stands in stark contrast to Betsy DeVos, the current U.S. education secretary. You can learn more about his background in these recent articles:

December 18, 2020

State economic outlook better than expected, but . . .

The Joint Budget Committee of the Colorado General Assembly is one of the most influential committees under the Gold Dome. The six members of the Committee face the unenviable task every year of crafting a state budget that usually features too many needs and not enough resources. This is never more true than this year. As JBC members look towards the work of the General Assembly in 2021 the effects of the COVID-19 health pandemic are coming into focus.

The Joint Budget Committee (JBC) members were presented with some of the potential challenges when the state's December Economic & Revenue Forecast was presented. The JBC receives two forecasts, one from the Legislative Council Staff and the other from the Governor’s Office of State Planning and Budget.

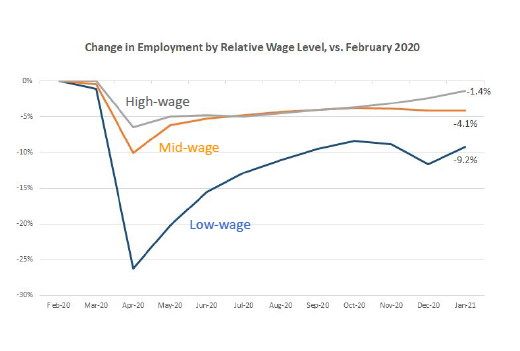

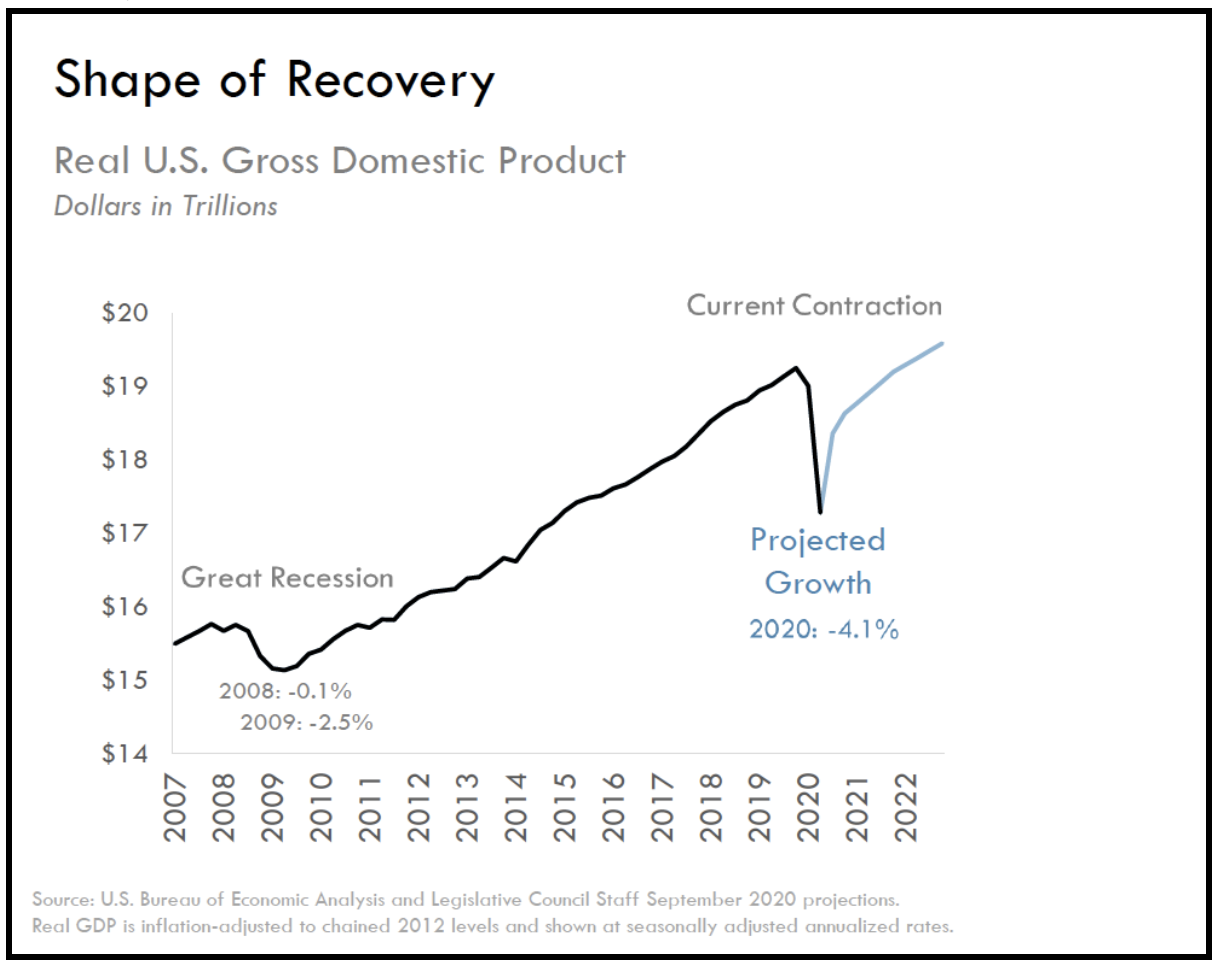

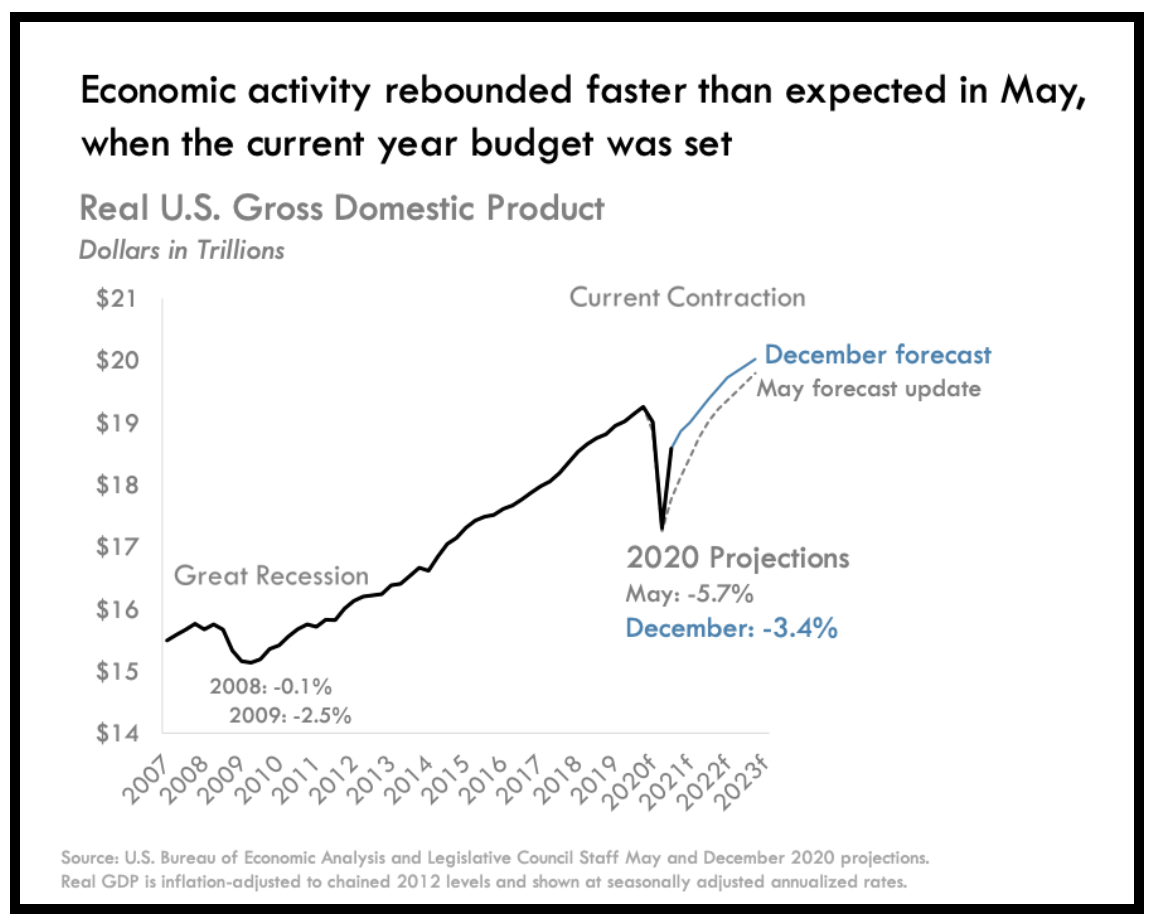

The Legislative Council Staff forecast report brought some good news. In general terms, Colorado’s economy has rebounded upwards from the recessionary bottom the state saw during the springtime height of the COVID virus health pandemic. The chart below highlights what is called the “K” shaped recovery to date.

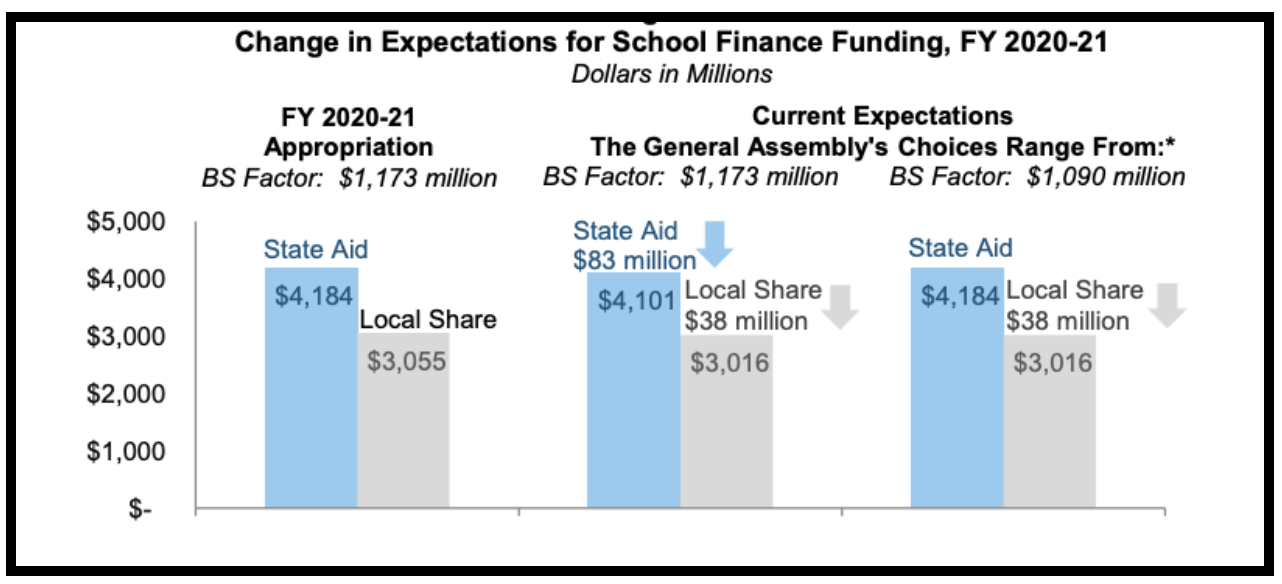

The news of most interest to CASB members is related to School Finance (which starts on page 19 of the forecast). Colorado schools have seen a decline in enrollment related to the current health pandemic. Approximately five thousand fewer full-time students were counted during the state’s October pupil census. Additionally, nearly 53,000 students funded in the at-risk category can’t be accounted for. The reduction of student enrollment is something the state hasn’t seen in decades. These declines are almost entirely due to the COVID health pandemic and state economists don’t anticipate these numbers to persist. There remain questions about the future of students who have opted to “home school” or to “online” programs and when or if they will return to their neighborhood schools.. In the near term these numbers pose problems for 2020-21 and 2021-22 budgets as they relate to school finance.

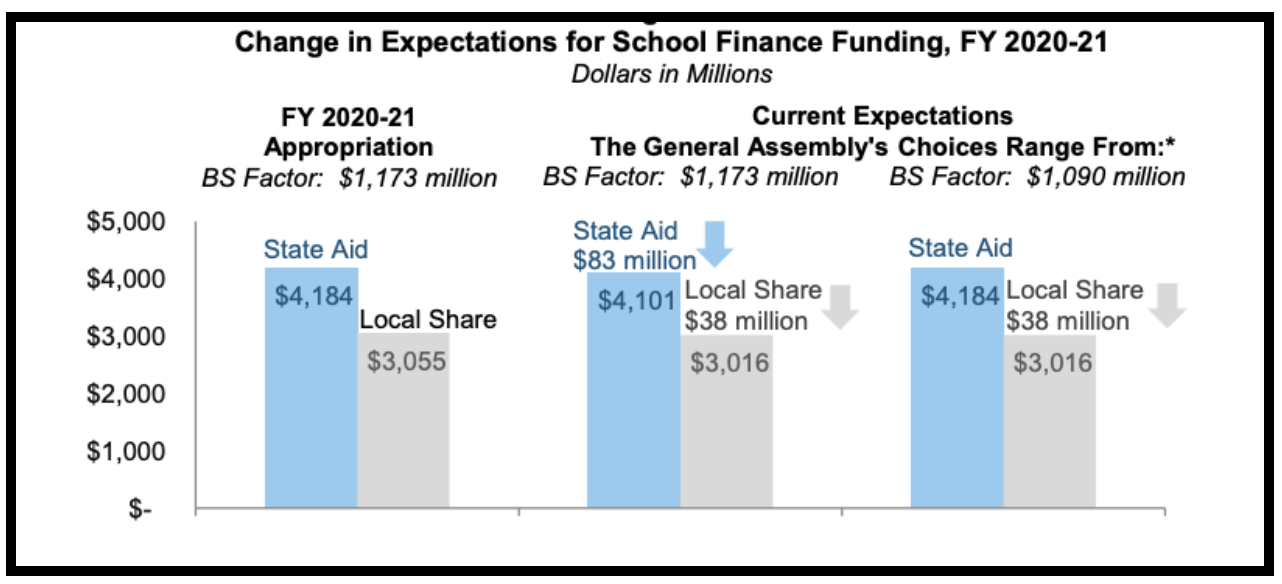

The majority of funding for Colorado’s public schools is a combination of local funds and state dollars. The student enrollment decline and lower than expected revenue from local property taxes related to school finance are shown in the chart below. With the combination of reduced student enrollment and less local property tax dollars, the General Assembly potentially will have the option to fund approximately $83 million less than they budgeted for in the 2020-21 budget.

Governor Jared Polis’s Office of State Budget and Planning forecast highlighted some additional risks to the revenue picture. These include how quickly COVID vaccines will be able to be rolled out and if additional federal COVID relief is approved by Congress before they adjourn.

The decision now facing the General Assembly will be how to address these shortfalls. Colorado schools face a slew of additional costs as they continue to educate our students while at the same time dealing with pandemic restrictions Costs related to pandemic effects - including cleaning, staffing, and remote learning - have all been more expensive than anticipated while the majority of funds appropriated early in the pandemic to address these costs have been spent. It will be critical for CASB members to advocate for the General Assembly to not impose additional funding cuts. If you are not sure how to connect with your legislator, CASB members can access the CASB Advocacy Toolbox (login required) on the website for resources to assist you in your outreach efforts. Additionally, please consider signing a petition asking lawmakers to ensure money intended for public education be used to help our students overcome the hurdles they have faced in the past months related to the COVID 19 shutdowns.

The December revenue forecast is the final hearing for the Joint Budget Committee before they adjourn for the December holidays. The entire General Assembly is scheduled to convene on Wednesday, January 13, 2021, however the ongoing virus is likely to alter legislators’ schedules into the new year.

Tell the Legislature: Now would be the worst time to cut school funding.

|

This year, COVID has caused a 3.3% reduction in public school enrollment. In normal times, the state has often reduced funding mid-year for districts that have lower enrollment than anticipated. But these times are not normal.

While the number of children in school — in-person and remote — has declined, school costs have most certainly not. In fact, keeping our students and teachers safe and supported costs more now than ever.

As supporters of public education, we are asking legislators to maintain school funding at the level passed in the 2020 legislative session. COVID may have reduced enrollment, but it has increased costs. Let our districts serve our students.

|

ACT NOW! Sign the petition: https://greateducation.salsalabs.org/notimetocut

December 3, 2020

COVID relief on the way with $382.2 million approved by General Assembly

Colorado lawmakers, called into a special session by worries about the rising economic toll of COVID-19 and congressional deadlock over additional federal relief, took the minimum required three days to pass 10 bills containing $382.2 million of state relief.

Governor Jared Polis in his official “call” for the special session, asked lawmakers to take action on the following:

-

Tax relief and direct grants to many hard-hit businesses

-

Grants to school districts to acquire the technology needed for remote learning

-

Assistance for child care centers to help them stay open

-

Programs used to help low-income Coloradans with housing and utility costs

-

Replenish the state’s Disaster Emergency Fund

Of the bills approved all had bipartisan sponsorship, and all passed with comfortable margins.

The bills have finite amounts of money, and the assistance is generally time-limited. Of the total, $233 million is direct state spending and another $149.2 million is revenue the state will forego through tax forgiveness measures. The Polis administration has said revenue collections that were higher than those forecasted last spring should provide the funds needed.

Governor Polis called the special session because he believed some immediate state relief measures were needed before the end of 2020 when current federal aid expires. The Governor has an ambitious list of other pandemic-related initiatives totaling nearly $1 billion. These initiatives will require action by the newly-elected General Assembly which convenes on Jan. 13, 2021.

The bills that are likely to be of interest to CASB members are listed below. Follow this link for a full list of all the bills that were introduced, including full details and fiscal notes.

Several bills were amended in significant ways from the introduced versions; those changes are also included in the bill tracker.

HB20B-1001 – Sponsored by Representatives Young and Soper and Senators Donovan, Coram, and Bridges — Provides $20 million to the Department of Education for grants to school districts to increase internet access and aid remote learning. The Colorado Department of Education has committed to making the funds available within 60 days of the grants opening.

HB20B-1002 – Sponsored by Representatives Kipp, Landgraf, and McCluskie and Senators Pettersen, Sonnenberg, and Priola — Appropriates $45 million to the Department of Human Services for two grant programs to sustain child care centers and expand access to child care. School-based programs are eligible for these funds if the program is not fully funded by Federal or State funds.

HB20B-1003 – Sponsored by Representatives Cutter and Bockenfeld and Senators Story and Hisey — Modifies and expands the Department of Human Services food pantry grant program by $5 million.

HB20B-1004 – Sponsored by Representatives Alex Valdez, Van Winkle, and Herod and Senators Bridges, Tate, and Winter — Allows qualified retailers to retain state sales taxes for a limited time. The measure reduces state revenues by $92.1 million over two years.

SB20B-001 – Sponsored by Senators Winter and Priola and Representatives Herod and Sandridge — Provides direct grants and suspension of certain fees to certain small businesses, arts organizations, and minority-owned businesses, chiefly those affected by health-related capacity limitations. The fiscal impact on state revenues is $57.1 million.

SB 20B-002 – Sponsored by Senators Gonzales and Holbert and Representatives Exum and Tipper — Moves $60 million from the General Fund to cash funds supporting housing assistance programs run by the Department of Local Affairs.

SB20B-004 – Sponsored by Senator Moreno and Representative McCluskie — Transfers $100 million from the General Fund and allows its use in the Disaster Emergency Fund.

Attention now turns to the December Quarterly revenue forecast on Friday, December 18. The forecast is always important as a final check on the economy before the Legislative Session starts in January. This year the data will be especially important as Coloradans look for signs of the strength of the economy.

All CASB members are invited to attend Zoom meetings with members of the Joint Budget Committee on Tuesday, December 8, 2020 at 1:00 pm. - The Zoom meeting link is available here - and with the Governor’s office on Thursday, December 10, 2020 at 2:00 pm - The Zoom meeting link for this meeting is available here. The meetings will be recorded and made available to CASB members who are unable to attend the live meetings.

November 30, 2020

Colorado General Assembly begins Special Session